Accelerated computing company Nvidia (NASDAQ: NVDA) was the best-performing stock in the S&P 500 last year. Its share price rocketed 239% as investors positioned their portfolios around artificial intelligence (AI) stocks. But that fantastic performance was merely the most recent chapter in a longer growth story still being written.

The artificial intelligence (AI) market is expected to compound at 37% annually to approach $2 trillion by 2030, and Nvidia has positioned itself as a major beneficiary. In fact, CFRA analyst Angelo Zino recently told Business Insider that “Nvidia is clearly going to be the biggest winner” as that opportunity unfolds.

Here’s what investors should know.

Here’s how much Nvidia stock returned in each year since 2000

Nvidia stock gained over 31,400% over the last 24 years, compounding at 27.4% annually. To put that in context, $10,000 invested in the company in January 2000 would be worth about $3.1 million today.

The chart below shows how much Nvidia’s stock price increased (or decreased) in each year between 2000 and 2023.

In 1999, Nvidia invented the graphics processing unit (GPU), bringing revolutionary visual effects to the gaming and multimedia markets. Those chips have become the gold standard in video game graphics and professional visualization. Nvidia holds more than 95% of the market in workstation graphics processors, and its chips were used to create every film that received an Academy Award nomination for best visual effects in the last 15 years.

In 2006, Nvidia introduced its CUDA programming model. That innovation turned its GPUs into general purpose processors and paved the way for data center dominance. Nvidia GPUs are now the gold standard in accelerating data center workloads like AI, data science, and scientific computing. In fact, the company holds about 95% market share in data center GPUs, and it holds 80% to 95% market share in AI chips.

Nvidia has further expanded its data center footprint by branching into adjacent hardware markets. It acquired high-performance networking company Mellanox in 2019, and it took aim at Intel and Advanced Micro Devices by launching a central processing unit (CPU) in 2023. The InfiniBand and Spectrum-X networking platforms and Grace CPUs are purpose-built for AI, and the company has already seen strong traction across those product lines. Specifically, networking is a $10 billion business, and CPUs are on pace to be a multibillion-dollar business in the near future, according to management.

In 2021, Nvidia branched into subscription software with AI Enterprise, a platform that simplifies the development and deployment of AI applications across various disciplines. The software suite includes frameworks that streamline the creation of recommender systems for retail, intelligent avatars for customer service, and computer vision systems for autonomous machines in logistics and manufacturing.

In 2023, the company delved into cloud services with Omniverse Cloud and DGX Cloud. Those platforms bring together supercomputing infrastructure, software, and pretrained machine learning models to support the development of 3D, AI, and robotics applications. Additionally, Nvidia recently announced foundry services that lean on DGX Cloud to help businesses customize large language models and build generative AI applications for text, images, videos, and drug discovery.

In short, Nvidia has evolved from a GPU company into a full-stack data center computing company focused on graphics and AI. Its ability to provide solutions across infrastructure, software, and services further cements its leadership in those markets. To quote Zino, “We believe … [Nvidia’s] full-stack AI/software capabilities provide an incredible competitive moat.”

Nvidia reported phenomenal financial results in the third quarter

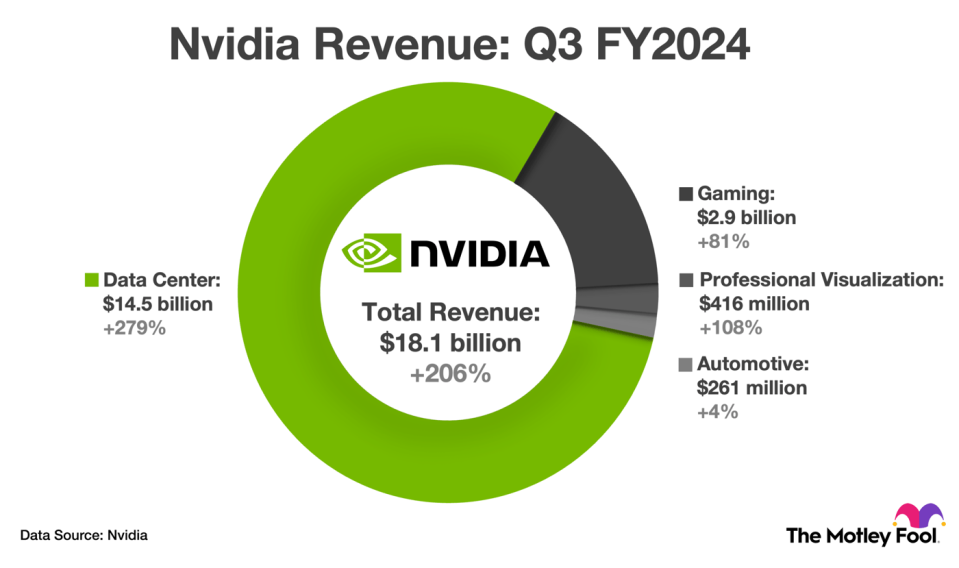

Nvidia looked untouchable in the third quarter. Revenue soared 206% to $18.1 billion on record sales in the data center segment, as well as strong momentum in gaming and professional visualization. Meanwhile, non-GAAP (adjusted) net income increased 588% to $10 billion as high-margin software and services accounted for more of total revenue.

The graphic below shows revenue across each business segment in the third quarter of fiscal 2024 (ended Oct. 29, 2023).

Nvidia stock trades at a reasonable price

As mentioned, AI spending across hardware, software, and services is forecast to increase at 37% annually through 2030. Meanwhile, the graphics processor market is expected to expand at roughly 28% annually during the same period. Nvidia is exceptionally well positioned to monetize both tailwinds, perhaps more so than any other company.

In any case, Wall Street analysts expect the company to grow sales at 40% annually over the next five years. That consensus estimate makes its current valuation of 23.6 times sales appear quite reasonable. Patient investors with a five-year time horizon should feel comfortable buying a small position in Nvidia stock today.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Monster AI Growth Stock Up 31,400% Since 2000 to Buy Now and Hold Long-Term was originally published by The Motley Fool

Signup bonus from