As a Dividend King, industrial giant 3M (NYSE: MMM) has increased its dividend annually for more than half a century. That’s an incredible track record to go along with the stock’s historically high 5.5% dividend yield. But don’t jump just yet — there’s more you need to know before you buy this stock. In fact, even getting in while the stock is still below $110 per share may not be as attractive as you might think.

Last year ended on a strong note for 3M

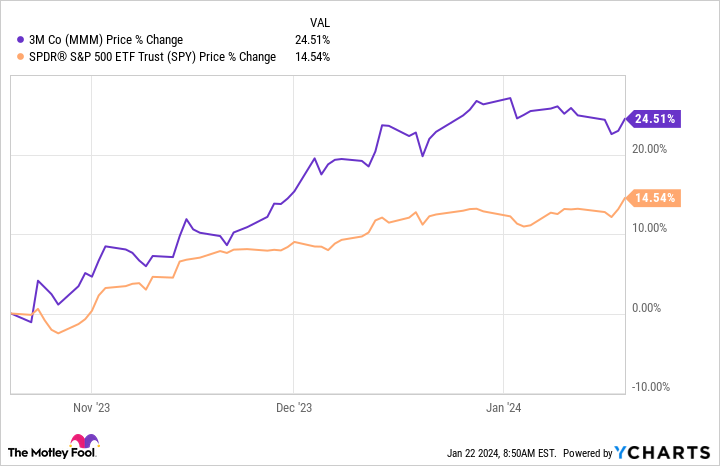

While the S&P 500 Index rallied at the end of 2023 and into 2024, so, too, did 3M’s stock. In fact, over the past three months, 3M’s shares are up roughly 25%, compared to a 15% or so gain for the S&P. That’s a pretty impressive showing for 3M, and investors might wonder if there’s still time to get in.

The answer seems to be a resounding yes, given that 3M stock is down around 20% over the past decade, versus a gain of roughly 160% for the S&P 500. But the numbers get worse if you measure from 3M’s high-water mark in 2018. From that peak, the stock has fallen nearly 60%, even after the rally over the last three months. A look at the stock graph over the past year, meanwhile, shows a peak of around $110 per share in the middle of 2023 that is being tested again today.

Given the business backdrop at 3M, though, it isn’t clear that a high dividend yield and rallying stock price will be enough to make it a buy for most investors.

A host of problems at 3M

There are three main reasons for investors to be worried about 3M’s future. The first is the most newsworthy — it has faced a slew of legal and regulatory challenges in recent years. The list includes product liability lawsuits surrounding ear plugs it sold to the U.S. military, environmental issues surrounding forever chemicals it produced, and lawsuits that have come from the forever chemicals problem.

These are costly issues to deal with from a legal perspective, but they have also proven to be multi-billion-dollar issues as 3M works toward settling legal claims associated with them. The company is likely to muddle through all the turmoil, but because of the nature of the problems, it can’t share information with investors on its progress. Thus, investors are left in a knowledge void, which should probably dissuade conservative investors from investing in the stock.

The second issue here is that, at least partly because of the legal issues, 3M is planning to spin off its healthcare division. This is a big shakeup of the business, as healthcare was expected to be a key driver of growth at the industrial company. The company is likely jettisoning what some would consider its crown jewels to raise capital to help pay for its legal problems and to protect this division from the effect of the legal headwinds. But without healthcare, 3M probably won’t be as attractive an investment over the long term.

The third issue for investors to consider here is a bit harder to quantify. There have been notable questions around 3M’s ability to innovate. This was a strong suit of the company, historically speaking, but the results from its research and development efforts have been less than impressive of late. It has been so bad that The Wall Street Journal even wrote a long-form article, including interviews with former employees, that suggested that 3M might have lost its way on the innovation front. R&D tends to be a bit lumpy on the results front, but this concern added to the two above just makes the uncertainty at 3M even higher.

Overall, 3M looks like a turnaround stock — and that’s a type of stock that only more aggressive investors should be buying.

Forget 3M’s price and look at the bigger picture

The specific stock price that 3M fetches on any given day is probably not the most important thing that investors should be looking at. The backstory here is much more important given the complexity and uncertainty involved in its troubles. Unless you have a very strong constitution, you’ll probably want to watch 3M from the sidelines until there is more clarity around the business, no matter what price the stock is sitting at on any given day.

Should you invest $1,000 in 3M right now?

Before you buy stock in 3M, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and 3M wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Reuben Gregg Brewer has positions in 3M. The Motley Fool recommends 3M. The Motley Fool has a disclosure policy.

Should You Buy 3M While It’s Below $110? was originally published by The Motley Fool

Signup bonus from