Helping businesses find, acquire, and grow customers, ZoomInfo Technologies (NASDAQ: ZI) and its business-to-business data platform has been on an absolute roller-coaster ride in its first few years as a public company. After making it through what might’ve been one of the worst possible times to go public in June 2020, ZoomInfo’s stock rocketed to new all-time highs by 2021.

Bolstered by low interest rates and a venture capital market asking businesses to grow at all costs, ZoomInfo’s sales-growth-focused platform was in high demand, with revenue spiking by 57% in 2021. However, things couldn’t be more different just a few years later.

With soaring interest and inflation rates — and the (incorrect) expectation for a U.S. recession in 2023 — these same venture capital firms asking for growth in 2021 now needed to see profitability above all else. These factors put ZoomInfo’s products on the back burner, leaving the company’s sales growth at just 9% in its most recent quarter.

However, with its stock down about 80% from its all-time highs due to factors largely out of its control, ZoomInfo and its market-leading services are finally attractively priced and could be poised for a turnaround.

ZoomInfo’s go-to-market RevOS platform

ZoomInfo gathers data on companies and business professionals by monitoring its network of sources and more than 1 billion public websites. With this mountain of information, the company leans upon artificial intelligence (AI) and machine learning (ML) engines to standardize, sort, clean, match, and verify this processed data at a market-leading scale.

Consistently updating this data, ZoomInfo provides its customers with insights such as a company’s sales figures, locations, job titles, contact information, and even technologies and keywords associated with their operations. Using this treasure trove of data, the company’s RevOS platform offers go-to-market details for a business, focusing on four specific areas:

-

SalesOS: Contact and company data, buyer intent, website visitor and contact tracking, and lead generation

-

MarketingOS: Display and social advertising, account-based marketing, audience solutions, abandoned form tracking, and form enrichment

-

OperationsOS: Data as a service, data quality management (cleansing, enrichment, duplication removal), and customer lead scoring and routing

-

TalentOS: Recruitment intelligence and automation, talent engagement and management, employer branding, and recruitment marketing

While understanding most of these product categories may require a leap of faith from most investors not working in this industry, ZoomInfo has a quickly growing list of accolades highlighting its leadership in its niche.

For example, G2, a research firm known for its peer-to-peer reviews and insights on the complex world of business software, recognized ZoomInfo as the top enterprise platform in 10 categories of its Winter 2024 Grid Reports. These products covered the following categories: buyer intent data, sales intelligence, market intelligence, website visitor identification, marketing account intelligence, account data management, lead intelligence, email verification, lead capture, and lead mining.

Holding a leadership position in these niches — the vast majority of which are sales-growth driven — ZoomInfo looks ready to thrive once the macroeconomic environment improves.

And the good news for investors?

ZoomInfo’s impressive margin profile and strong free-cash-flow (FCF) creation leave it well positioned to ride out an extended downturn.

High margins, immense free cash flow, and a buyback plan

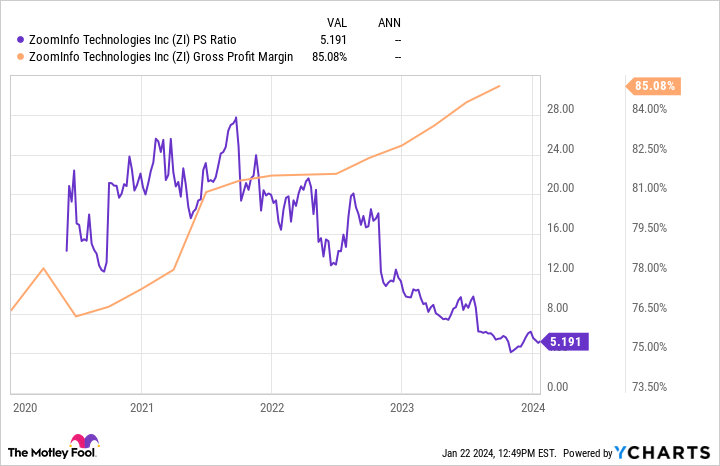

In addition to ZoomInfo’s leadership position in its go-to-market niche, the company’s financial profile has consistently improved — despite its price-to-sales (P/S) ratio declining from 24 to 5 in just over two years. This disconnect between a plummeting valuation and improving operations can lead to promising opportunities for investors — which may be the case with ZoomInfo.

Consider the company’s gross profit margin compared to its P/S ratio over the last few years.

This steadily rising gross profit margin highlights the power of ZoomInfo’s operating model. It pays to collect data up front but collects additional profits each time it repurposes this data for existing customers or adds new clients. Better yet for investors, this isn’t only seen in the company’s gross profit margin, but also on the bottom line in its free cash flow.

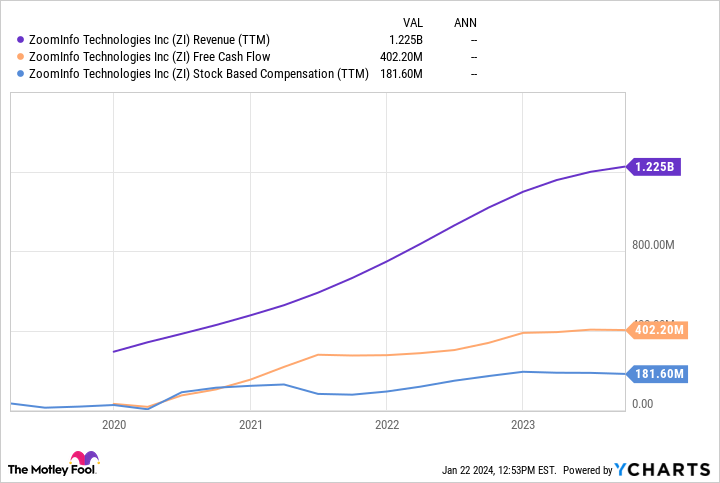

Growing revenue and FCF by more than 300% and 1,200%, respectively, since the company’s initial public offering, ZoomInfo has developed a robust 18% FCF margin — even after backing out stock-based compensation. Keeping $0.18 for every dollar of sales it makes, ZoomInfo quickly grew its cash balance from $50 million in 2020 to more than $600 million in 2023.

Armed with this cash balance, management announced a $600 million buyback authorization and immediately put it to work, buying back more than 3% of its total shares outstanding over the last year.

Thanks to ZoomInfo’s strong FCF creation, its cash hoard, and a willingness to buy back its own shares at a discounted price, I’m more than happy to wait for a turnaround in the economy and dollar-cost average into a position of this data leader in 2024.

Should you invest $1,000 in ZoomInfo Technologies right now?

Before you buy stock in ZoomInfo Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ZoomInfo Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Josh Kohn-Lindquist has positions in ZoomInfo Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Top Growth Stock Down 80% to Buy in 2024 and Hold Forever was originally published by The Motley Fool

Signup bonus from