Chip stocks soared over the last year, thanks to increased interest in artificial intelligence (AI). Market leader Nvidia‘s stock has climbed 234% since last January, as its graphics processing units (GPUs) became the go-to for AI developers worldwide.

However, competition is expected to heat up in the AI chip sector this year, which could present more attractive ways to invest in the budding market. Advanced Micro Devices (NASDAQ: AMD) is a compelling option, as it’s gearing up to begin shipping its most powerful GPU ever.

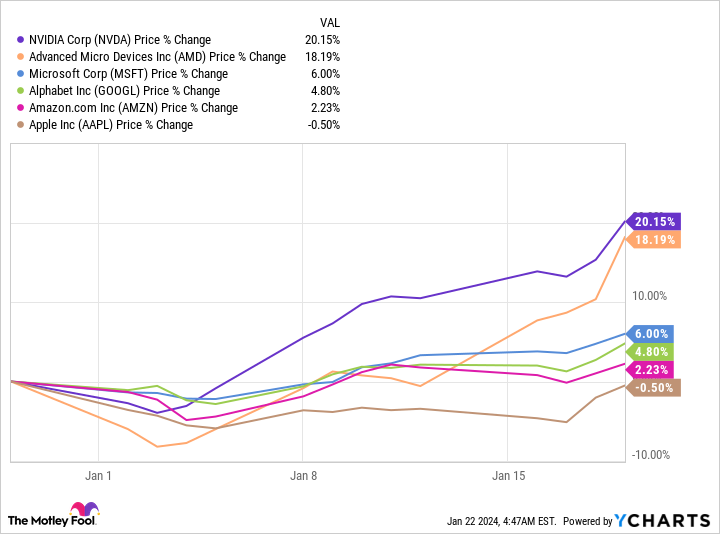

AMD is already off to a stellar start, being one of the few tech companies to keep up with Nvidia’s stock growth in the first few weeks of 2024. However, AMD could outperform its biggest rival in the coming months as its earnings begin to reflect its heavy investment in AI.

So forget Nvidia: AMD is poised for a potential bull run in 2024.

AMD has massive potential in AI

Data from Grand View Research shows the AI market hit nearly $200 billion last year and is projected to expand at a compound annual growth rate (CAGR) of 37% until at least 2030. That trajectory would see the industry exceed $1 trillion before the end of the decade.

AI’s significant growth potential suggests AMD won’t need to dethrone Nvidia to still see major gains from the sector. As a result, the recent launch of its MI300X AI GPUs could see earnings soar this year.

AMD unveiled the new chip last December, promising it is on par with Nvidia’s H100 for training and that it beats the H100 for inference by 10% to 20%. And it’s already attracting some of tech’s biggest players.

Microsoft announced in November that its Azure cloud platform would become the first such platform to use the MI300X to optimize its AI capabilities. Microsoft holds a 49% stake in OpenAI, making the company a powerful partner for AMD. Alongside an agreement with Meta Platforms — which will see it utilizing the new chips as well — AMD’s future in AI looks bright.

In 2023, Nvidia became the first chipmaker to exceed a market cap of $1 trillion. AMD still has a long way to go before coming anywhere close to that figure, with its market cap at $281 billion. However, that could mean it has far more growth potential over the long term.

The PC market finally returned to growth

Macroeconomic headwinds brought steep declines in the PC market in 2022 and for much of last year. Spikes in inflation led to reductions in consumer spending, with PC shipments tumbling 16% year over year in 2022 and continuing to fall in the first three quarters of 2023. Chipmakers across tech were hit hard by the declines, with AMD’s PC-focused client segment posting a 10% year-over-year dip in revenue in fiscal 2022.

However, a recovery finally seems to be underway, and AMD is positioned to profit significantly from market improvements.

Worldwide PC shipments increased for the first time in over a year in the fourth quarter of 2023, rising by 0.3%. In the same period (AMD’s Q3 2023), revenue in the tech firm’s client segment rose 42% to $1.5 billion. Meanwhile, client operating income hit $140 million, improving on the $26 million in losses it posted in the year-ago period.

The PC market is expected to continue improving throughout 2024, likely offering AMD consistent revenue boosts.

AMD is projected to outperform the S&P 500 and Nasdaq

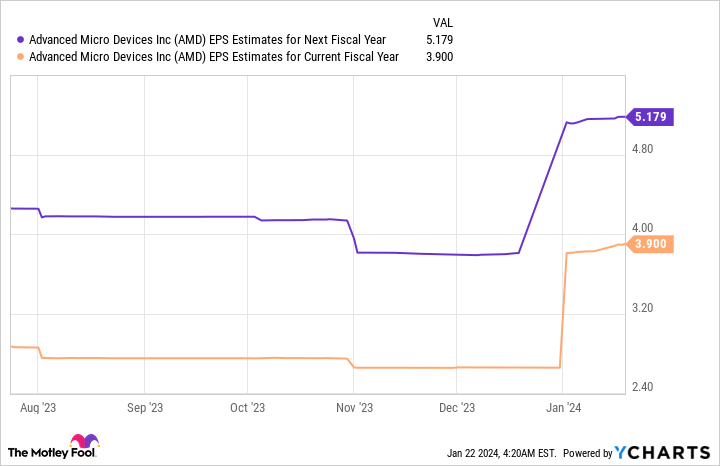

AMD’s earnings could hit $5 per share by its next fiscal year. That figure, multiplied by its forward price-to-earnings ratio of 45, implies a potential stock price of $225 per share. If projections are correct, AMD’s stock would rise 30% over the next year.

Since 2019, the S&P 500 and Nasdaq Composite rose at annual growth rates of 16% and 23%, respectively. AMD’s stock has significantly more growth potential than both of those figures. Alongside a solid outlook in AI and an improving PC market, AMD is a no-brainer in 2024 and worth considering over Nvidia.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

Forget Nvidia: This Stock Is Poised for a Potential Bull Run in 2024 was originally published by The Motley Fool

Signup bonus from