The Nasdaq-100 Technology Sector index was in roaring form last year as it gained nearly 54% thanks to a variety of tailwinds, including the growing adoption of artificial intelligence (AI), cooling inflation, and a resilient economy. And the good part is that the index could keep heading higher in 2024.

Historical data collected by fintech brokerage firm Capex.com suggests that a year in which the Nasdaq-100 clocks a gain of more than 40% is followed by another year of gains — barring 1999, when the dot-com bubble was about to burst. These trends indicate that the Nasdaq-100 could jump 24% this year from 2023 levels.

Wall Street is also positive about the Nasdaq-100’s prospects, predicting that the index could land between 17,000 and 18,500 this year. Using the higher end of the estimate, that would be a 10% jump from current levels. While past performance is definitely not an indicator of how the market could perform in the future, tailwinds such as a potential cut in interest rates by the Federal Reserve could send the Nasdaq-100 even higher.

That’s why now would be a good time to take a look at Nvidia (NASDAQ: NVDA), a chipmaker that saw major growth thanks to the booming demand for its AI chips. The stock has had a terrific start in 2024 with gains of more than 10% already, and it probably won’t be long before this semiconductor stock hits a $2 trillion market cap. Let’s see why.

A $2 trillion market cap isn’t too far away for Nvidia

The stock’s AI-fueled surge in the past year has brought the company’s market cap to $1.35 trillion, making it the world’s sixth-largest company. This means Nvidia needs to jump another 48% from current levels to enter the $2 trillion club. There is a strong chance it could achieve that mark sooner rather than later given how fast its earnings are growing.

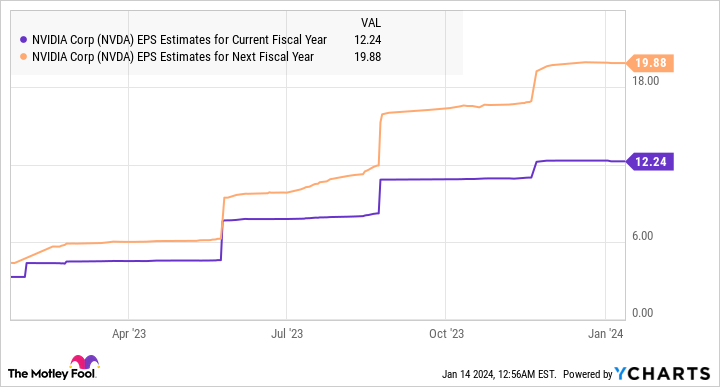

Nvidia is expected to finish its fiscal 2024 (which will end this month) with $12.25 in earnings per share (EPS), a big jump from the $3.34 in fiscal 2023. And as the following chart suggests, EPS could jump another 63% in the new fiscal year, beginning next month.

Nvidia currently has a forward earnings multiple of 55, higher than its five-year average of 42. Assuming it trades at a discounted 42 times after a year, in line with the five-year average, and hits Wall Street’s estimated earnings target, its stock price could jump to $835. That would be a 52% jump from current levels.

So, the possibility of Nvidia hitting $2 trillion in market cap over the next year or so cannot be ruled out thanks to a collection of tailwinds.

Multiple growth drivers should help this chip stock sustain its bull run

Shares are up an impressive 223% in the past year as the company’s data center business has taken off with the robust demand for its AI chips. The good news is that Nvidia is set to benefit from more growth drivers in the coming year, along with AI, which could supercharge the company’s earnings.

For example, the gaming market seems all set to move the needle in a bigger way for Nvidia thanks to the growth in the personal computer (PC) market, as well as the adoption of AI-enabled PCs. The company’s gaming revenue was up 81% year over year in the third quarter of fiscal 2024 (which ended on Oct. 29) to $2.86 billion.

The trend is likely to continue as PC sales are expected to rebound 8% in 2024 from a decline of 12.4% last year, according to technology market analyst Canalys.

Another catalyst for Nvidia’s PC business is that a big chunk of gamers are expected to upgrade their systems this year. According to a survey of 1,000 PC builders conducted by DFC Intelligence, 53% of respondents who built their PCs in 2020 plan to upgrade or build a new PC within the next year, while 84% are likely to upgrade within the next couple of years.

These tailwinds should ideally lead to higher demand for Nvidia’s gaming GPUs (graphics processing units). Jon Peddie Research says that the shipments of discrete GPUs, which are used for gaming, increased 37% sequentially in the third quarter of 2023, indicating that this market is already in turnaround mode. Considering Nvidia’s 80% share of the discrete GPU market, the company is in a position to capitalize on this turnaround.

Meanwhile, the growing adoption of digital twins (virtual models of real-life objects) could turn out to be another catalyst for Nvidia in 2024. This market is expected to clock annual growth of 30% through 2027 as more and more manufacturers are forecast to adopt this technology to improve their operations. The company is already benefiting from this trend as major organizations have started deploying its digital-twin solutions. Given that this market could hit an estimated $92 billion in 2029, it could have a huge impact on Nvidia’s business in the long run.

Considering that Nvidia enjoys terrific pricing power and market share in the fast-growing market for AI chips, there are several reasons why the company is on track for outstanding growth over the next year, and beyond.

All this indicates that investors would do well to buy Nvidia before the Nasdaq-100 heads higher in 2024, especially since this AI stock isn’t as expensive when compared to the other chipmakers looking to capitalize on this market.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

History Says the Nasdaq Will Surge in 2024: 1 Magnificent Growth Stock to Buy Before It Joins the $2 Trillion Club was originally published by The Motley Fool

Signup bonus from