A powerful bipartisan duo announced a significant tax deal Tuesday that would combine an expansion of the child tax credit with long-sought provisions for the business world.

It’s a deal that faces uncertain prospects of being enacted. But if it can find its way into law by the end of this month, it could even be felt during the upcoming tax filing season.

The pact is the culmination of months of talks that have long centered around an idea of pairing a Republican priority to renew three expired business-world deductions from the 2017 Trump tax cuts with a keen Democratic focus on the pandemic-era enhanced child tax credit.

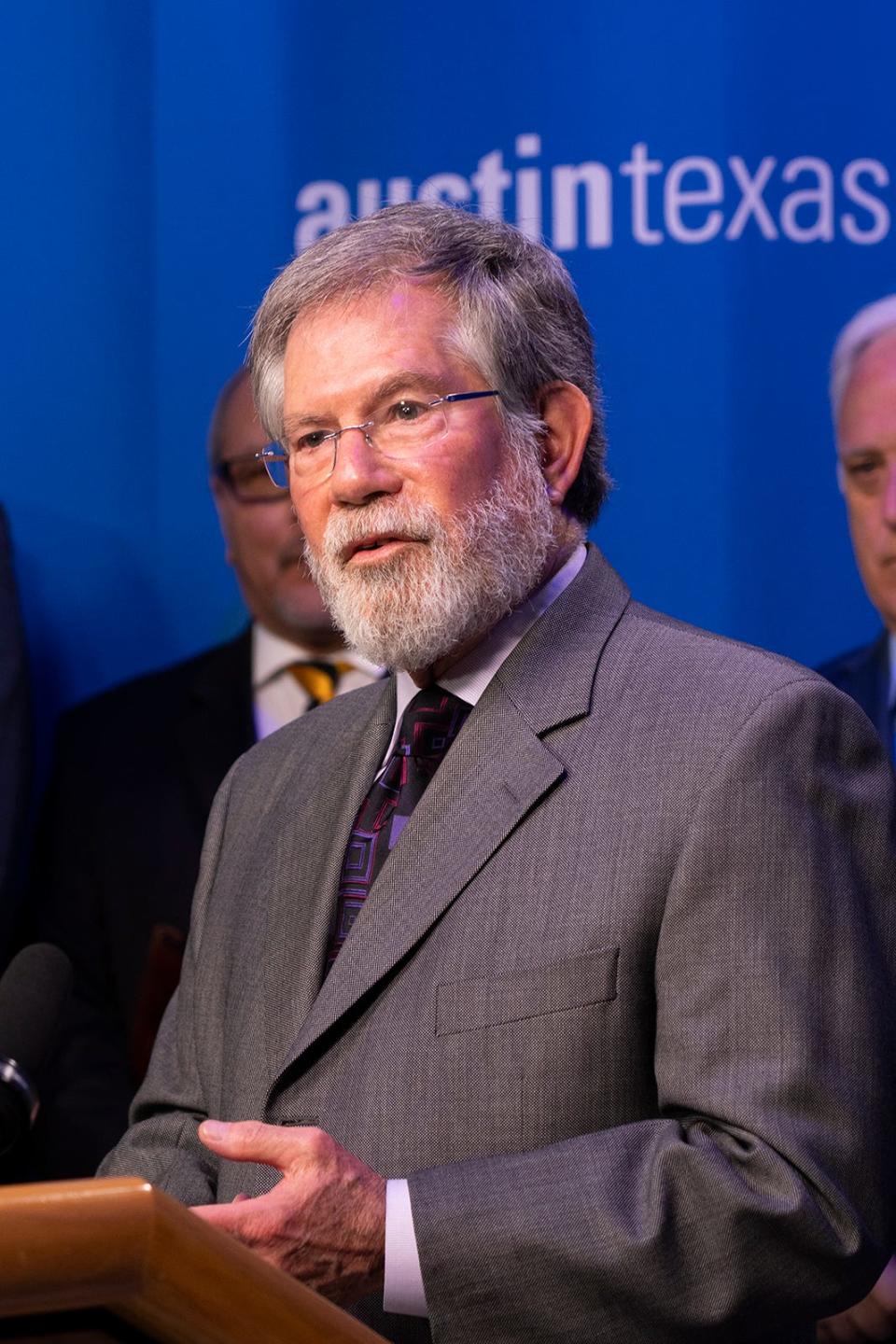

“Fifteen million kids from low-income families will be better off as a result of this plan,” said Senate Finance Committee Chair Ron Wyden (D-Ore.) in a statement Tuesday adding “and given today’s miserable political climate, it’s a big deal to have this opportunity to pass pro-family policy.”

The plan from Wyden and House Ways and Means Chair Jason Smith (R-Mo.) is being dubbed the “Tax Relief for American Families and Workers Act of 2024” and would allow larger families greater access to the child tax credit while also phasing in a refundable portion to gradually allow the poorest families to access the full current credit of $2,000.

The deal also includes a significant change by adjusting the tax credit for inflation starting in 2024.

The deal marks a return of sorts for the landmark credit that temporarily helped to cut child poverty in half. That one-year measure was signed into law in 2021 by President Biden and was structured differently by temporarily raising the credit to a maximum of $3,600 per child. It also made the credit refundable and paid out as monthly benefits.

One last-minute addition to the package announced Tuesday was another measure designed to increase the supply of low-income housing through an enhanced low-income housing tax credit. The housing portion of the deal would also lessen an existing bond financing requirement.

The deal now faces a difficult challenge in actually being passed and signed into law but boasts powerful backers who will push it in the weeks ahead.

The significant bipartisan breakthrough also comes ahead of a 2025 that is expected to be heavily focused on tax debate in Washington with a host of additional tax breaks included in the 2017 Trump tax cuts set to expire on Dec. 31, 2025.

Changes for the business world

The deal also includes the restoration of three tax changes for the corporate world that began to expire at the end of 2021. The bill would allow companies to deduct more for things like research and development, equipment investments, and interest costs.

The deal “strengthens Main Street businesses, boosts our competitiveness with China, and creates jobs,” said Rep. Smith in his statement, adding an estimate that the provisions would support over 21 million jobs.

The research and development provisions are the centerpiece of the corporate provisions and would allow companies to again access upfront deductions for domestic research and development. They would get an immediate tax break if it’s enacted, rather than the current five-year window.

The deal immediately gained business-world backing with Business Roundtable CEO Joshua Bolten saying Tuesday morning that “all three of these tax policies have a long history of bipartisan support and are critical to strengthening America’s global competitiveness.”

In a recent interview, Erica York of Washington’s Tax Foundation said the lack of those credits, which also expired at the end of 2021, were eating into America’s business standing especially vis-à-vis China.

It “doesn’t matter what industry you’re in, the tax treatment of that got worse this year [and] it’ll get worse next year and the following years” as the provisions continue to phase out, she said.

The deal also includes a provision to remove a long-bemoaned quirk that led companies with a footprint in both the United States and Taiwan to face double taxation.

An uncertain political landscape

The deal comes with a price tag of over $70 billion and will be paid for, the lawmakers say, by ending the pandemic-era employee retention credit.

That program — which Tuesday’s bipartisan release notes was “hit by major cost overruns and fraud” — would be amended to have an accelerated deadline for filing backdated claims.

That program had been designed to help certain businesses keep employees on the books during the pandemic. But it has been the subject of controversy after the news that as many as 20,000 applications for the credit would be disqualified because of filers who tried to access the program in 2020 and 2021 but used either entities that did not exist or businesses with no paid employees.

The child tax credit provisions would notably not increase the credit itself but would allow larger families greater access and also make portions more refundable, meaning the benefits could be open to the poorest families who don’t make enough to trigger the credit currently.

Still, it could run into some resistance from the left. As reports began to circulate, Adam Ruben of the Economic Security Project Action recently said the changes “would be an improvement for many [but it still] falls short of what they need.”

The credit has long been a Democratic priority but gained some notable allies across the aisle. In one memorable 2022 letter, figures like Newt Gingrich and Mike Huckabee argued for an expansion of the credit.

The hope now among the negotiators is to pass something quickly, even by the end of this month, to make the changes retroactive to 2023. But it faces uncertainty some lawmakers potentially resistant to the deal and a packed Congressional agenda including a possible partial government shutdown at the end of this week.

Still, “my goal remains to get this passed in time for families and businesses to benefit in this upcoming tax filing season, and I’m going to pull out all the stops to get that done,” says Wyden.

This post has been updated with additional developments.

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Signup bonus from