Artificial intelligence (AI) is poised to be this century’s most revolutionary technology trend and deliver incredible wins for investors who back the right companies. On the other hand, this exciting new technology shift is also still in its infancy, and investing in the space comes with risk.

When it comes to balancing risk and delivering big rewards, arguably no one is better than Berkshire Hathaway CEO Warren Buffett. So, if you’re looking for AI investment plays that are backed by high-quality businesses, taking some inspiration from the Oracle of Omaha could be a great move.

With that in mind, read on to see why investing in Snowflake (NYSE: SNOW) looks like a great move right now.

One of Berkshire’s most unusual bets

Berkshire Hathaway invested in Snowflake on the day of its initial public offering (IPO) in September 2020. To date, it’s the only stock that Buffett’s Berkshire has purchased at its IPO.

With an investment position valued around $1.2 billion, Snowflake only accounts for 0.3% of Berkshire’s roughly $361 billion stock portfolio. But it’s one of Berkshire’s largest pure-play software bets — and arguably the AI stock held by the investment conglomerate that has the most explosive long-term potential.

Snowflake is a leading provider of data warehousing and analytics technologies. The company’s Data Cloud platform makes it possible to combine and analyze information that is generated from applications that are run on Amazon‘s, Microsoft‘s, and Alphabet‘s respective cloud infrastructure platforms. That’s a crucial capability for large organizations these days, particularly those that are developing, running, and scaling up AI applications.

In a study conducted last year, 98% of large enterprises surveyed by S&P Global Intelligence reported that they were already using or planned to use services from two distinct cloud infrastructure providers. With most large organizations already depending on multicloud setups to run day-to-day technology operations, the data-warehousing and analytics services that Snowflake provides solve key problems and open up new insights and computing possibilities.

Snowflake is poised to expand rapidly

For the company’s 2024 fiscal year, which concludes at the end of this month, Snowflake estimates that it will record roughly $2.65 billion in product revenue, up 37% on an annual basis. Jump ahead five years, and the company expects it will close out its 2029 fiscal year with product revenue of approximately $10 billion. Based on those estimates, the company is targeting a compound annual growth rate of roughly 30% across that time span.

As impressive as the 37% growth the company predicts in fiscal 2024 is, what’s even more impressive is that it expects to record such strong sales expansion in the subsequent five years. And rather than sacrificing margins to sustain that, Snowflake actually expects profitability to increase along key fronts.

The table below tracks the projected progression of Snowflake’s adjusted gross margins for product revenue, adjusted operating income margins, and adjusted free cash flow (FCF) margins from fiscal 2024 through fiscal 2029.

|

Metric |

Fiscal 2024 |

Fiscal 2029 |

|---|---|---|

|

Adjusted gross margin |

77% |

78% |

|

Adjusted operating income margin |

7% |

25% |

|

Adjusted FCF margin |

27% |

30% |

Table by author; Data source: Snowflake.

While investors should consider the possibility that macroeconomic and business-specific pressures could cause the business to fall short of this forecast, the company has done a good job of hitting its performance targets so far. Snowflake’s current momentum and expansion opportunities suggest that its stock still offers big upside.

Snowflake looks poised to deliver big wins

Even with gains for the stock over the last year, the share price is still down roughly 51% from its high. There’s no denying that the company has a growth-dependent valuation.

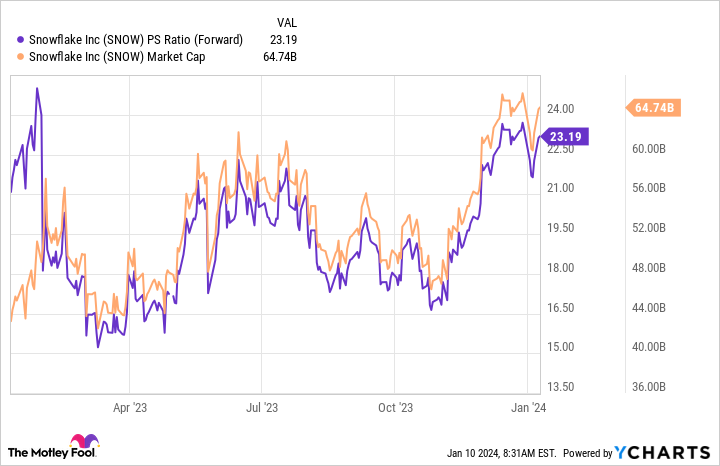

With a market capitalization of roughly $65 billion, Snowflake is valued at approximately 23 times the average Wall Street analyst’s target for expected sales in its current fiscal year. That’s a highly growth-dependent valuation profile that stands in stark contrast to most of the other stocks in Berkshire’s portfolio.

On the other hand, the company is trading at just over 21 times the $3 billion in annual free cash flow that the company expects five years from now. And crucially, there are good reasons to believe that the company could still be in a very early stage of its long-term growth story at that point.

For risk-tolerant investors seeking explosive AI plays, Snowflake could wind up being a massive long-term winner.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, Microsoft, and Snowflake. The Motley Fool has a disclosure policy.

1 No-Brainer Warren Buffett Artificial Intelligence (AI) Growth Stock Still Down 51% to Buy Hand Over Fist in 2024 was originally published by The Motley Fool

Signup bonus from