Growth investors often dream of becoming millionaires with a modest investment. They often hope to find the next Home Depot or Amazon before they become widely known, leading to outsized returns.

Finding such stocks is easier said than done, and promising growth stories often get derailed. However, one possible stock with such potential is Super Micro Computer (NASDAQ: SMCI).

What is Super Micro Computer?

Super Micro has existed for more than 30 years and has become a leading manufacturer of servers. The company bills itself as a “rack-scale” IT solutions provider. Along with servers, it produces switches, storage units, and high-end software services.

The rise of artificial intelligence (AI) has made it more critical for hardware and software to work together. That combined need plays into the hands of Super Micro, as most of the largest tech companies specialize in either hardware or software.

The company also adds additional attributes to gain an advantage. It boasts a customer base in more than 100 countries and controls around 6 million square feet of manufacturing space worldwide. Additionally, it designs environmentally friendly products focused on energy savings, an attribute that may add to its competitive advantages.

Super Micro’s path to growth

Nonetheless, investors have begun to catch on to the company’s potential, taking the AI stock about 300% higher over the last year. Consequently, its market cap now stands at about $18 billion, which means it holds a somewhat reduced potential to mint millionaires than a year ago.

Still, it’s likely not too late to invest. A 100-fold increase would leave it with a market cap comparable to some of its mega-tech competitors. Also, Grand View Research forecasts the data center market will reach $437 billion by 2030. That compound annual growth rate amounts to 11%, which probably leaves it with considerable room for growth.

Admittedly, growth may have taken a breather, as Super Micro’s revenue in the first quarter of fiscal 2024 (ended Sept. 30) was $2.1 billion, a yearly increase of 14%. In fiscal 2023, revenue rose 37% year over year.

Super Micro has increased research and development spending, as well as outlays on sales and marketing. Thus, its fiscal Q1 net income fell to $157 million, versus $184 million in the year-ago quarter. Still, profits grew by 125% in fiscal 2023, and the Q1 pullback looks temporary.

The company raised fiscal 2024 revenue guidance to a range of $10 billion to $11 billion. At the midpoint, that would amount to a 47% revenue increase if that prediction holds.

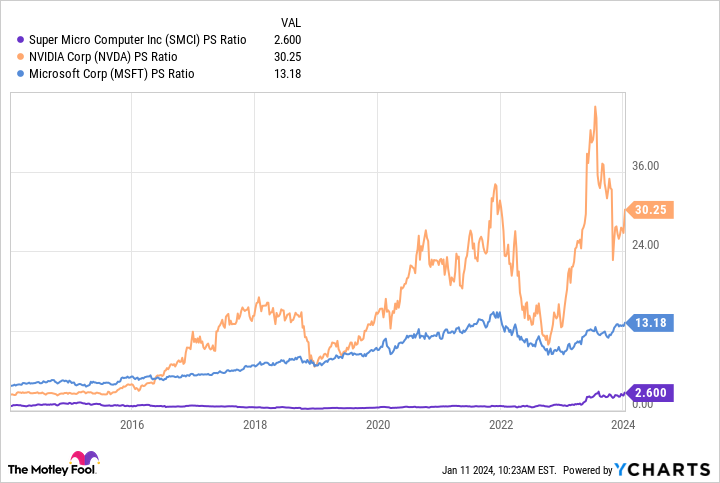

Moreover, its price-to-earnings ratio (P/E) is about 31, a low valuation considering the fiscal 2023 earnings growth. Furthermore, its price-to-sales ratio (P/S) is only 2.5. This compares well to Nvidia or Microsoft, with sales multiples well into the double digits. This could imply tremendous upside once more investors see Super Micro’s growth potential.

Super Micro as a millionaire-maker

Despite massive growth over the last year, Super Micro continues to have potential as a millionaire-maker. Thanks to AI, the need for servers where the hardware and software work seamlessly together is more critical than ever, and Super Micro is one of the few companies to combine those attributes explicitly.

Moreover, the $18 billion market cap takes it barely into large-cap territory, leaving tremendous potential for massive growth as AI adoption increases. Assuming the latest quarter is likely a temporary setback in Super Micro’s growth plans, investors could make massive gains by buying this growth name at a low valuation.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Home Depot, Microsoft, and Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

This Rebellious AI Stock Could Be a Millionaire-Maker was originally published by The Motley Fool

Signup bonus from