Hype around artificial intelligence (AI) rocked the markets in 2023, sending the tech-heavy Nasdaq soaring more than 40%.

The megacap Magnificent Seven stocks were at the epicenter of AI mania, and perhaps their most influential member is semiconductor manufacturer Nvidia (NASDAQ: NVDA). The company saw its market cap balloon in 2023, and it joined Apple, Microsoft, Amazon, and Alphabet in the exclusive $1 trillion market-cap club.

It’s no surprise that Wall Street analyst Dan Ives of Wedbush Securities crowned Nvidia as the godfather of AI.

After surging 237% last year, some might think now is the time for profit taking. But what if I told you that Nvidia stock could be undervalued?

Let’s explore how the company is leading the charge in AI, and why now might be as good a time as ever to scoop up some shares.

Demand is off the charts

Nvidia has developed a host of graphics processing units (GPUs). The bedrocks of its GPU line are the A100 and H100 chips, the latter of which is experiencing unprecedented demand.

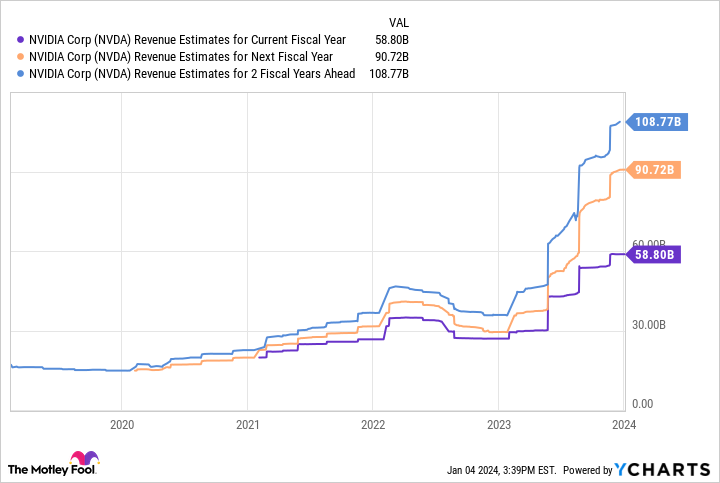

The chart above illustrates Nvidia’s quarterly revenue during the past decade. The big takeaway is that the slope of the line really steepens starting in 2023.

For the third quarter of the company’s fiscal 2024, ended Oct. 29, Nvidia reported a record $18.1 billion in revenue, an increase of more than 200% year over year. Moreover, the company’s profit increased nearly 500% through the first three quarters of its fiscal year.

If this wasn’t enough to get your attention, consider that Wall Street is forecasting revenue to rise 54% this fiscal year, followed by another 20% the year after. Although this technically shows decelerating revenue, I’d say that is appropriate.

It’s unrealistic for investors to expect triple-digit percentage revenue growth in perpetuity. Moreover, while Nvidia dominates the AI application market for data center GPUs, there are other competitors gaining steam.

With 2024 looking like another milestone year for Nvidia, investors might be wondering how attractive the stock is from a valuation perspective.

Nvidia’s valuation looks tempting

As of the time of this writing, the stock trades at a forward price-to-earnings (P/E) multiple of 24.8. By comparison, the company’s top competitor, Advanced Micro Devices, trades at a forward P/E of 37.

While AMD is making progress of its own, it is far behind Nvidia. Considering Nvidia’s growth relative to AMD, fueled by its dominant market share in AI data center GPUs, the disparity between valuation multiples is a head-scratcher.

On top of that, the forward P/E of the S&P 500 is 21.7 — not too far behind Nvidia. Given the company’s stellar performance in 2023 and its strong outlook for this year, it’s hard to see why Nvidia doesn’t carry a higher premium.

My hunch is that investors are acting with more emotion than logic when it comes to Nvidia. The stock’s performance throughout 2023 and the company’s admission to the $1 trillion market-cap club might give off vibes of an expensive stock. However, the multiples above could suggest that Nvidia is growing into its valuation, and the stock could actually be cheap.

I think Nvidia will continue to benefit from the secular tailwinds of AI, and now looks like a terrific time to begin dollar-cost averaging into a long-term position at a bargain.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

Wall Street Says This Company Is the “Godfather of AI.” Here’s Why I Think the Stock Looks Undervalued. was originally published by The Motley Fool

Signup bonus from