Intel (NASDAQ: INTC) just hit the market with some notable artificial intelligence (AI) news, and it didn’t involve new AI chips trying to play catch-up to Nvidia. Rather, the latest announcement involves Intel’s in-house generative AI software business, which is now being christened Articul8 AI.

With some outside investment help from data center, cell tower, and internet infrastructure manager DigitalBridge Group, as well as a consortium of other investment firms, Intel has spun off Articul8 AI as a separate company.

Of course, Intel did announce a slew of new chips aimed at various AI applications in December. The company is also receiving the first of a new batch of advanced machines from top semiconductor manufacturing equipment company ASML Holding, which will be critical to Intel’s roadmap of new chips in the coming years.

But why separate the AI software business, especially when Nvidia — the dominant player in AI training chips — has built its technological lead with a combination of hardware and software? And does Intel’s move to set Articul8 free make it a good investment for 2024?

Intel’s piggy bank strategy

Perhaps Intel’s release of Articul8 AI sounds familiar. Under the guidance of CEO Pat Gelsinger the last few years, Intel has been closing down non-strategic business lines and selling equity stakes in others to outside investors.

For example, in late 2022, Intel sold a small stake in its autonomous vehicle chip segment Mobileye, relisting the stock on public exchanges after it acquired it back in early 2018. It retains majority ownership of Mobileye at this point.

Something similar was accomplished with the sale of another subsidiary business, IMS Nanofabrication, over the summer of 2023. IMS makes the equipment used to fabricate key components (called photomasks) used in advanced ASML lithography machines (more on that in a moment). Intel sold a 20% stake in IMS to private equity company Bain Capital, and a couple of months later, another 10% stake in IMS to fellow chip manufacturer Taiwan Semiconductor Manufacturing (or simply TSMC), the leading chip manufacturer Intel is trying to chase down.

Most recently, Intel said it would be spinning off its programmable chip business within the next few years. This programmable chip unit, which specializes in a semiconductor type called FPGAs, was assembled primarily via the mega-acquisition of Altera back in 2015.

The disassembly of Intel, or something more?

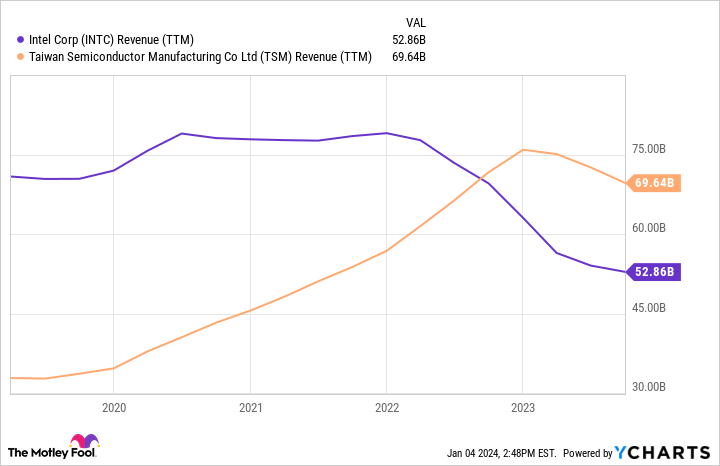

It’s clear Gelsinger and the top team at Intel want to raise cash. But this isn’t just the simple disassembly of the Intel semiconductor empire. Gelsinger has been clear he wants to return Intel to chip manufacturing greatness. TSMC passed Intel’s chip manufacturing technology capabilities a few years ago, and soon after surpassed Intel in terms of overall revenue.

The problem, in the eyes of many both inside and outside the semiconductor industry, is that TSMC poses supply chain and geopolitical risks — owing to China’s overtures toward reunifying the island of Taiwan with the rest of the country. Intel sees an opportunity to position its vast manufacturing capabilities, historically reserved for its own chip designs, as an alternative third-party contract manufacturer to TSMC.

A long list of fabless (no chipmaking, just engineering) semiconductor companies, including Nvidia, might be interested in diversifying their chip supply chain if Intel can accommodate.

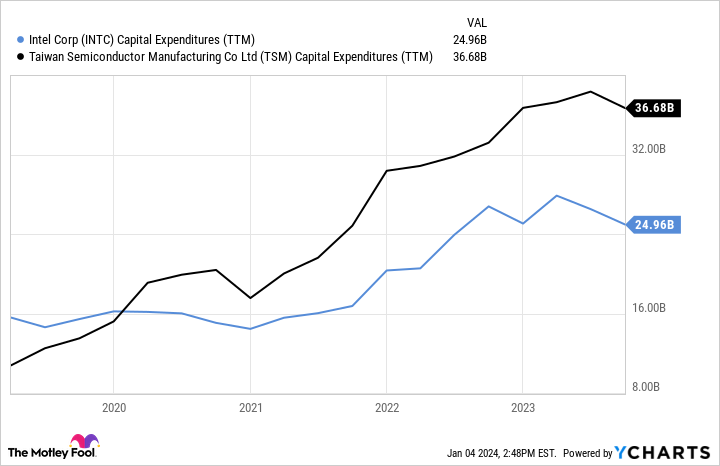

But therein lies the rub. Intel can’t just simply decide to compete with TSMC’s manufacturing prowess. It needs to purchase that capability. That’s where ASML’s lithography equipment, as well as other chip manufacturing equipment suppliers, come in. And ASML’s latest-and-greatest, its High-NA EUV lithography machines, don’t come cheap. These marvels of industrial technology cost upwards of $400 million each, plus ample ongoing operating expenses thereafter.

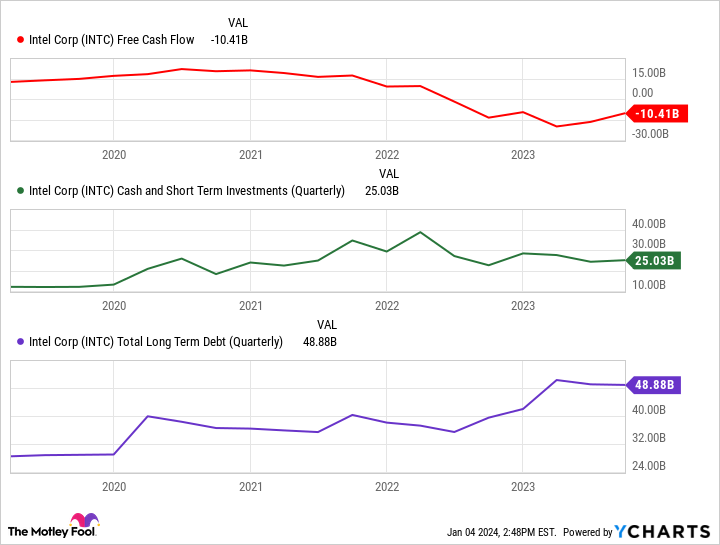

Suffice to say, Intel is in need of a lot of cash it doesn’t currently have on balance if it wants to retake the chip manufacturing technology crown from TSMC. As I wrote in November, Intel’s free cash flow was deeply negative in 2023, and it has far more debt than cash on balance.

And what is it up against? Heavy spending (in this case, capital expenditures on property and equipment) from highly profitable TSMC as it tries to maintain its leadership in chipmaking. So Intel has quite a ways to go to narrow the gap.

Bringing the AI software story full circle

And this is likely why Intel just announced another spinoff of one of its non-core assets, Articul8 AI. Intel gets to retain some ownership in the now-independent software company, which it will help with go-to-market strategies for the budding generative AI industry. But in the meantime, Intel also raised some cash for what is sure to be an expensive manufacturing journey in the coming years.

So does this most recent sale make Intel a buy? Perhaps, for the right investor. Just know the risk. Intel has lined up a steady stream of liquidity it can tap into in the coming years with all of these business sales to outside investors. Now it comes down to whether Intel can execute — and it will be difficult, given that the complexity of crafting next-gen chips is only rising.

I still count Intel as a higher-risk and only potentially higher-reward semiconductor rebound story at this juncture. There are other chip stocks with better risk-to-reward profiles out there right now.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Nicholas Rossolillo and his clients have positions in ASML and Nvidia. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and Mobileye Global and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Intel Is Selling a Stake in Its AI Software Business — Does That Make Intel Stock a Buy for 2024? was originally published by The Motley Fool

Signup bonus from