Yes, $1 trillion is a huge amount of money. It can, however, be hard to grasp exactly how big it is. So, here’s an example:

Imagine that $1 million was deposited into your bank account. Nice, right?

Now, imagine deposits continued every hour, on the hour, every day and continued — nonstop — for 50 years.

After all that time, you’d have $438 billion, a gargantuan amount of money. But to get to $1 trillion, the deposits would have to continue for another 65 years.

To put it another way, it would take 115 years to accumulate $1 trillion in this fashion.

Simply put, $1 trillion is an astoundingly large amount of dough. And yet, there are now five publicly traded American companies with market caps over $1 trillion. What’s more, the two biggest — Apple and Microsoft — have market caps of $3 trillion and $2.8 trillion, respectively.

Undoubtedly, many more companies will cross the $1 trillion mark in the years to come. And there’s one I believe can get there by 2028: Advanced Micro Devices (NASDAQ: AMD).

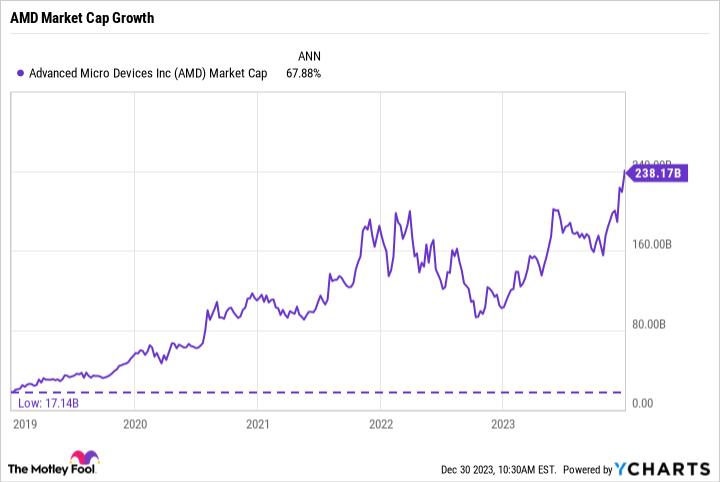

AMD’s market cap is growing at a staggering pace

Why do I think AMD can cross the $1 trillion mark by 2028? For starters, let’s look at AMD’s market cap today. As of this writing, AMD has a market cap of $238 billion, making it the 29th largest U.S. company, sandwiched between Salesforce and PepsiCo.

So, to reach $1 trillion by 2028, AMD would need to grow its market cap at a compound annual growth rate (CAGR) of 50% over the next four years:

|

Year |

Market Cap in Billions (with 50% Growth Rate YOY) |

|---|---|

|

2024 |

$238 |

|

2025 |

$357 |

|

2026 |

$536 |

|

2027 |

$803 |

|

2028 |

$1,205 |

Data source: Author’s calculations. YOY = year over year.

That would be an impressive feat, but consider this:

AMD has grown its market cap over the last five years at a CAGR of 68%, rising from $17 billion in 2019 to more than $238 billion as of this writing.

In other words, AMD just needs to maintain its market cap growth to hit the $1 trillion mark by 2028. That won’t be easy, but it’s certainly achievable.

AMD could ride the artificial intelligence wave to a $1 trillion valuation

What makes it possible — perhaps even likely — is the wild growth of the artificial intelligence (AI) market. As AMD CEO Lisa Su noted in a recent interview:

The AI market over the last year has just exploded. ChatGPT has really changed our perspective for what Generative AI can do. … We originally thought the total market for data center AI accelerators would be about $150 billion [in 2027]. Now, we think it will be over $400 billion.

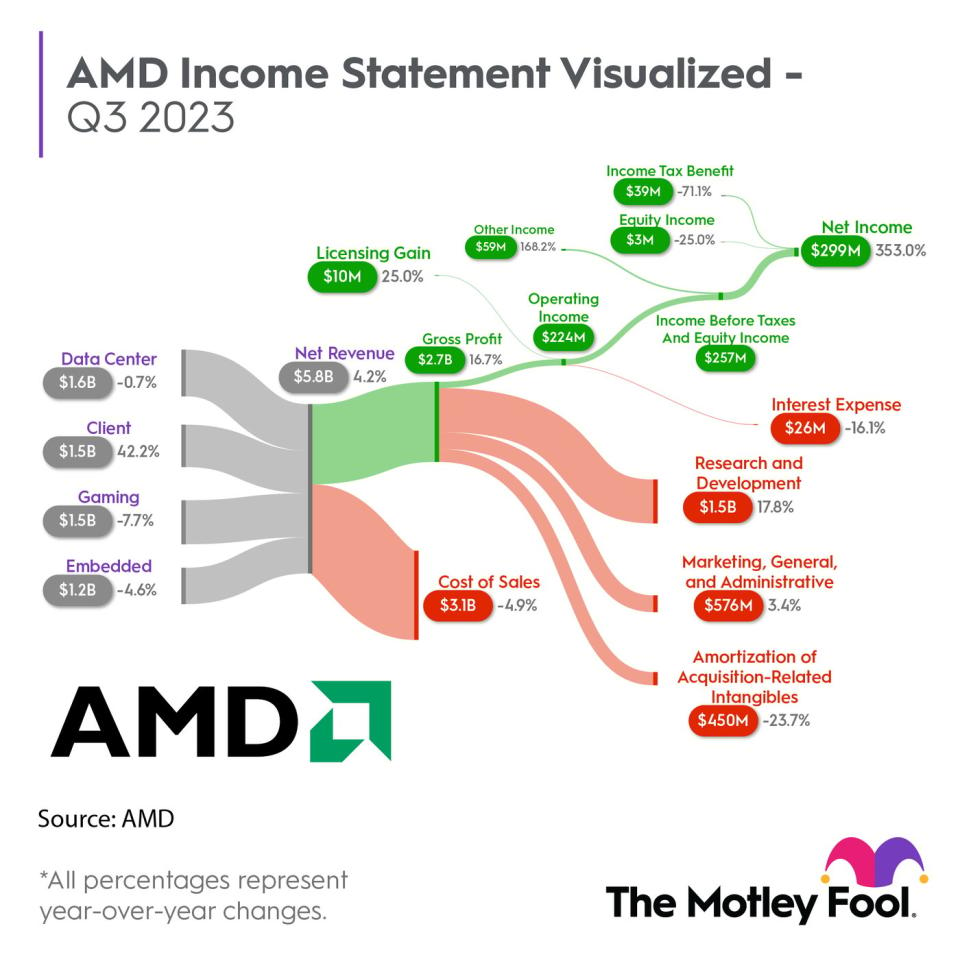

That’s eye-popping growth, and it stands to be an enormous tailwind for AMD. Currently, the company generates roughly a quarter of its revenue from its data center unit. However, with demand for AI accelerators through the roof, that segment should see enormous revenue growth in the coming years — in particular, due to the recent debut of its new adaptive processing unit chip, the MI300.

In short, AMD is a company with the wind at its back. The AI revolution is just getting started, and for it to keep rolling on, many AI chips will be needed. And while AMD hopes to compete head-to-head with Nvidia for AI chip supremacy, there’s plenty of room for both. And in time, AMD might just join Nvidia in the $1 trillion market cap club.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Jake Lerch has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, Nvidia, and Salesforce. The Motley Fool has a disclosure policy.

1 Company That Could Be Worth $1 Trillion by 2028 was originally published by The Motley Fool

Signup bonus from