Chipmakers were among Wall Street’s favorites in 2023 as their hardware is crucial to countless industries. And as interest in artificial intelligence (AI) soared, so did demand for graphics processing units (GPUs) — the powerful chips necessary for training and running AI models. That propelled skyrocketing valuations for chip stocks like Advanced Micro Devices (NASDAQ: AMD), which climbed by 128% over the last 12 months.

AMD has ramped up its expansion into AI as it prepares to challenge Nvidia‘s overwhelming dominance in that market in 2024. Meanwhile, its diverse business gives it solid positions in several other high-growth niches. As a result, there are plenty of reasons to be bullish about AMD’s future.

However, before you jump into its stock, it would be wise to consider both the positives and potential negatives. So here are two reasons to buy AMD and one reason to sell.

One reason to buy: AMD has massive earnings potential in AI

AMD’s biggest competitor, Nvidia, has seen its business explode in 2023 as it has cornered the market in AI GPUs. The company has an estimated 90% market share in AI chips, and its earnings have skyrocketed. In its fiscal 2024 third quarter, which ended Oct. 29, Nvidia posted revenue growth of 206% year over year while operating income rose 1,600% thanks to surging chip sales.

Nvidia’s success is promising for its rival, considering that AMD will begin shipping its most powerful GPU ever in 2024. The new chip is designed specifically to compete with Nvidia’s offerings. Meanwhile, Microsoft — a crucial client for AMD — has already signed on to use the GPU to optimize the AI features in its Azure cloud service.

Nvidia’s near-total command of the AI chip market will likely be challenging to overcome. However, AMD doesn’t need to dethrone the leader to enjoy big gains here. According to a projection from Grand View Research, the AI market will expand at a compound annual rate of 37% through 2030 to a value of more than $1 trillion.

With that type of rapid growth, there will be plenty of room for AMD to claim a lucrative slice of the AI pie.

Another reason to buy: A diverse business model

The tech industry is advancing quickly, with companies increasingly seeking high-powered chips to take their products to the next level. As a result, AMD has formed partnerships with companies across the market, supplying its hardware to cloud platforms, video game consoles, laptops, custom-built PCs, and more.

In fact, AMD is the exclusive chip supplier for Sony‘s PlayStation 5 and Microsoft’s Xbox Series X|S, some of the best-selling game consoles of the last few years. The success of these consoles has boosted AMD’s gaming revenue by 30% over the last three years as its operating income has climbed 72%.

A position in AMD’s stock allows investors to profit from the growth of multiple industries. Its shares have risen nearly 730% since 2019, significantly outperforming the Nasdaq Composite and S&P 500. And the company is only just getting started, with AI likely to propel the stock further along its current trajectory.

One reason to look elsewhere

AMD has a solid long-term outlook. Its chips power an array of devices and systems, and it could see consistent and significant financial growth for decades. However, its stock price soared in 2023 even as it made heavy investments in AI that have yet to start positively impacting its earnings. As a result, its shares are quite expensive by some valuation metrics right now.

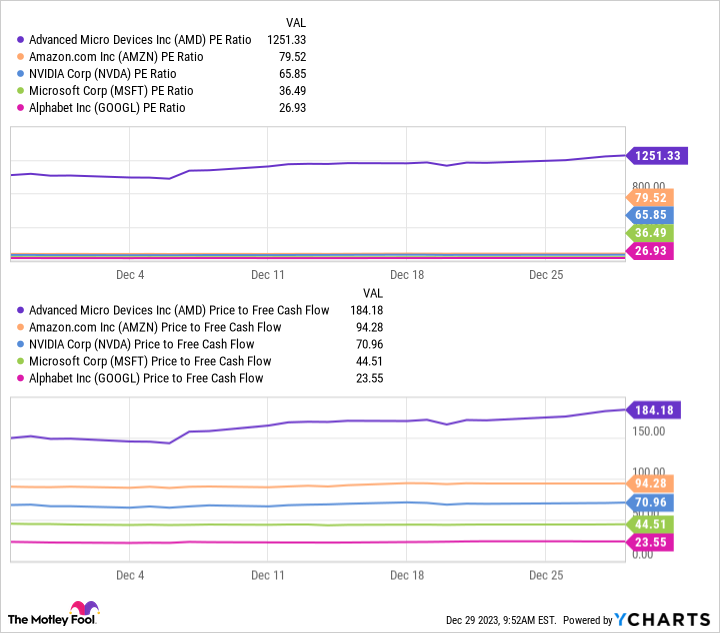

These charts compare the price-to-earnings ratios (P/E) and price-to-free cash flows of some of the biggest names in AI and tech. AMD has by far the highest figures for both valuation metrics, meaning its stock offers the least value.

The company looks likely to make serious headway in the AI segment with its soon-to-be-launched AI GPU. However, it’s hard to justify its high price point. It might be worth investing in an alternative AI stock for now, and keeping AMD on your radar to reconsider when its valuation comes down to a more attractive level.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

2 Reasons to Buy AMD, and 1 Reason to Sell was originally published by The Motley Fool

Signup bonus from