When it comes to serious savings and funds needed over the longer term, investors shouldn’t be afraid to pay a premium for a quality stock. If you can buy a quality stock at a relatively low price, though, so much the better.

Here are three high-quality, low-cost value stocks, meeting that description, that you could buy sizable stakes in now and hold on to for years.

U.S. Bancorp

While U.S. Bancorp (NYSE: USB) is one of the 10 largest financial institutions in the country, it is smaller than the likes of JPMorgan Chase or Bank of America, and doesn’t do as much business in certain areas the banking giants are best known for. For instance, corporate fundraising, institutional trading, and wealth management aren’t major profit centers for U.S. Bank. This limits its revenue and earnings growth prospects, particularly when the economy is firing on all cylinders.

Yet in many ways, a simpler suite of product and service offerings is advantageous to U.S. Bancorp’s investors. Primary among that — the bank can better focus on doing the things it does (like consumer lending) well. And its results are more predictable because they’re less cyclical.

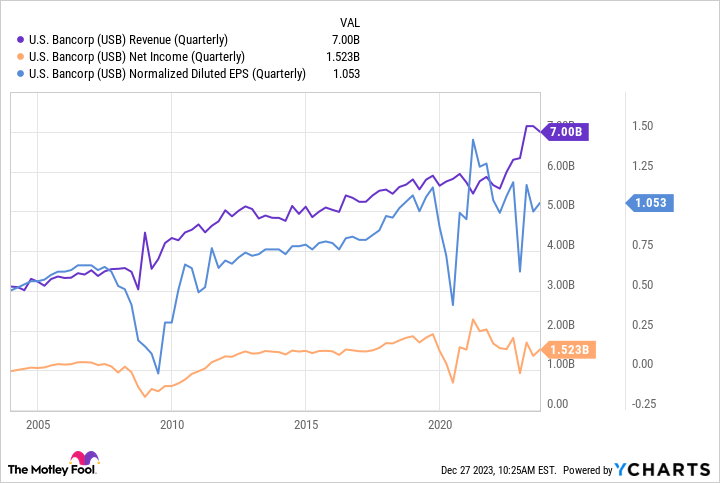

That’s what the graph below shows us. While the subprime mortgage meltdown and the COVID-19 pandemic clearly undermined its top and bottom lines, it’s also clear that U.S. Bancorp quickly recovered from both and got back on its long-standing growth track. Not every bigger banking outfit can say the same.

Boring? A little. But that’s the point — if you’re going to be sitting on a stock for many years, you want to be able to count on the underlying company’s progress. U.S. Bancorp reliably logs it, even if never at tremendous speed. And shareholders collect decent dividends all the while. Its yield of 4.4% at the current share price is better than average.

Newcomers will be stepping into U.S. Bank’s stock at 13.1 times earnings, and only 10.4 times its forward earnings.

Pfizer

Shares of Pfizer (NYSE: PFE) may not be as cheap as U.S. Bancorp’s are — the drugmaker’s price-to-earnings ratio stands at 15.5, while its forward price-to-earnings ratio is a little under 12. Still, those valuations are cheap, and certainly below average pharmaceutical stock valuations right now.

There’s no sense in ignoring the 800-pound gorilla in the room here: Governments are effectively winding down their intense efforts to combat COVID-19. Although new variants continue to surface, and a seasonal surge in new cases is underway, demand for vaccines and treatments is waning. Pfizer’s third-quarter revenue fell 42% year over year, with slumping sales of the company’s COVID products responsible for the entirety of that dip. Don’t be surprised to see this weakness linger at least a little while longer.

Just don’t tarry too long if you’re considering eventually opening a new position in Pfizer stock. The current quarter should be the last one to show a major year-over-year sales tumble due to people’s fading concerns about the virus. Beginning in early 2024, Pfizer’s business results will largely reflect demand for everything else in its portfolio and pipeline.

And that’s exciting, to be sure.

Among other things, Pfizer owns blood thinner Eliquis, cardiomyopathy treatment Vyndaqel, pneumonia vaccine Prevnar, and cancer-fighting Ibrance, to name just a few. These are all blockbuster drugs, but they haven’t realized their full potential yet because of the pandemic. Never even mind its pipeline, where you’ll find sickle cell disease treatment Oxbryta, multiple myeloma therapy Elranatamab, and hemophilia drug Marstacimab. All told, Pfizer believes its current pipeline could be producing $20 billion worth of annual revenue by 2030, contributing to up to $84 billion worth of annual companywide sales that year thanks to its recent acquisition of Seagen. From here, the company will put its focus back on these longer-lived opportunities.

The kicker: There are credible plans to simultaneously begin culling at least $4 billion worth of annual costs.

There’s not a lot not to like here if you’re truly looking a few years down the road.

Taiwan Semiconductor Manufacturing Company

Last but not least, add Taiwan Semiconductor Manufacturing Company (NYSE: TSM) to your list of value stocks to buy now and hold for years.

It’s not exactly a household name. In fact, there’s a decent chance you’ve never even heard of the company, which also goes by TSMC. There’s also a strong chance, however, that you’re using technology manufactured by Taiwan Semiconductor right now without even realizing it.

Although tech giants like Intel and Nvidia are starting to handle more of their own manufacturing, the bulk of this work is still farmed out to third parties capable of cranking out silicon designed by more familiar players. Taiwan Semiconductor Manufacturing Company isn’t just one of these contract manufacturers. It’s the world’s biggest, with more than half of the third-party semiconductor fabrication market.

The company was hit as hard as any other by the COVID-19 pandemic, which not only crimped demand, but banged up supply chains as well (coming and going). The turbulence is still bumping the business around, too. Analysts believe Taiwan Semiconductor is on pace to fall nearly 9% for the full year.

The supply headaches of the pandemic have also inspired several big tech names to become more self-sufficient. Intel is investing billions of dollars to build two different chip foundries in the United States, for example, while Micron has budgeted up to $100 billion to build what it refers to as a “megafab” in central New York.

Yet, despite these initiatives, the world still needs third-party chip foundries. This is going to remain the case for a long while, too, if not forever. In fact, Taiwan Semiconductor is so certain its advanced capabilities and services will remain in demand for the foreseeable future that it’s building its own production facility in Arizona. And, given the 19.5% revenue growth expected of the company in the coming year, that’s arguably the right call. It’s a sign that the chip business is recovering, and bringing Taiwan Semiconductor along for the ride.

Trading at a forward price-to-earnings ratio of 16.6, TSMC isn’t exactly a screaming value. However, it’s below this ticker’s recent average earnings ratio, and below the valuations many of its peers are sporting right now.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, JPMorgan Chase, Nvidia, Pfizer, Taiwan Semiconductor Manufacturing, and U.S. Bancorp. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Got $5,000? Buy and Hold These 3 Value Stocks for Years was originally published by The Motley Fool

Signup bonus from