Only five U.S. companies have market caps over $1 trillion right now — Apple, Microsoft, Alphabet, Amazon, and Nvidia, in that order. There are others coming up the pipeline, though, as the markets reach or get close to new records.

It would be very hard to knock one of these five mammoth companies off their perches. Still, there are up-and-coming stocks that are growing a lot faster, and they could enter the top five at some point. If you have a long time horizon and a patient approach to investing, there are reasons that MercadoLibre (NASDAQ: MELI) could become a trillion-dollar stock. It’s also a top growth stock to own regardless of your time horizon.

Growth drivers and opportunities

MercadoLibre is an e-commerce platform in Latin America, but it’s a lot more than that. It has built a huge fintech business, which it started by figuring out a way for underbanked customers to be able to shop on its digital platform. That resulted in a digital payment platform that has now expanded into a full financial services app and credit business.

The company has been around since 1999, almost as long as Amazon. MercadoLibre went public in 2007, and it’s still reporting incredibly high growth. During the peak of the pandemic, it reported triple-digit sales growth for five consecutive quarters. While that’s decelerated, it’s still high double digits. Total sales increased 69% year over year in the third quarter, while Amazon’s increased 9%.

The core e-commerce business is still robust. Gross merchandise volume increased nearly 60% year over year in the 2023 third quarter, and items sold accelerated for the fourth consecutive quarter. More than 80% of orders were delivered within 48 hours.

Amazon is a global company, and at least so far MercadoLibre’s target market is the 18 Latin American countries it serves. Together, though, that’s a target market of about 600 million people, and these are countries with similar languages and geographies that make fast shipping easier.

In fintech, total payment volume (TPV) increased 121% over last year, with off-platform TPV increasing 145%. The credit portfolio increased 23%.

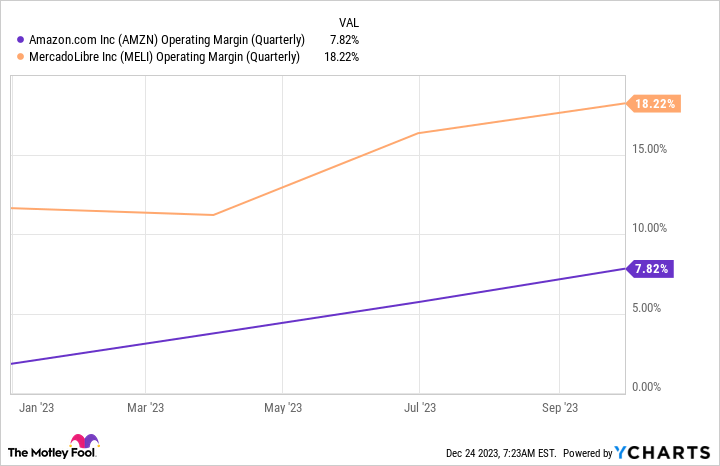

Not only is MercadoLibre growing faster than Amazon, but it has a much wider operating margin.

Can MercadoLibre really unseat Amazon?

Let’s go through how this could work practically. MercadoLibre has a market cap of only $80 billion, a pittance as compared with Amazon’s $1.5 trillion. It would take a lot of time to get even close to Amazon, which is why I chose 2039 as even a possibility.

But it’s a faster-growing company, and MercadoLibre stock is also gaining more than Amazon. Over the past 10 years, it’s more than doubled Amazon’s stock gains. If it repeated the same gains, in 10 years it still wouldn’t even be where Amazon is today. But what about in 15 years?

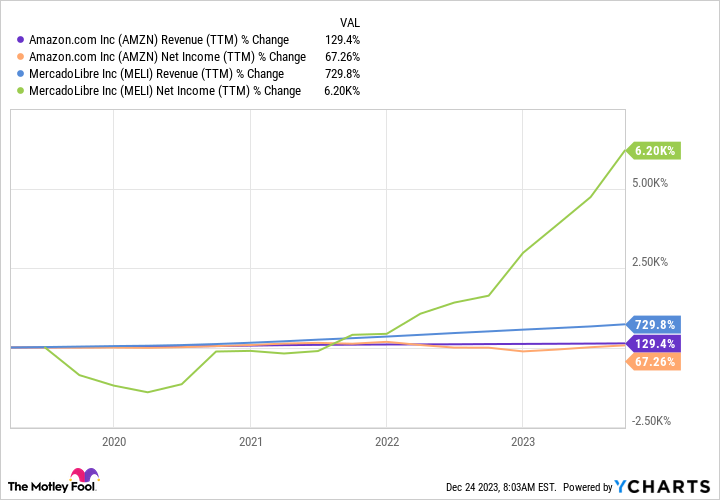

Over the past five years, MercadoLibre’s revenue and net income growth have highly outpaced Amazon’s.

Using a compound annual growth rate of 50%, MercadoLibre’s annual revenue would be more than $5 trillion in 15 years! While that would make it highly plausible that it could challenge Amazon’s market cap, it’s not likely to stay at 50% growth for 15 years. Using 25% as an average instead, it could reach around $370 billion in sales in 15 years. Using its current price-to-sales ratio of 6, that would lead to a market cap of $2.2 trillion. That may or may not exceed Amazon’s market cap in 15 years, and a lower price-to-sales ratio would mean a lower market cap. However, the point is to see that it’s a possibility.

I’ll admit, it’s not likely for Amazon to get dethroned any time soon, or even in 15 years, and I think it’s a great stock to own. Looking as far into the future as 2039 isn’t likely to be very accurate either, since there are too many factors that could change over 15 years. But this exercise highlights why MercadoLibre might be a better growth stock to buy right now.

Whether or not it’s worth more than Amazon by 2039, MercadoLibre could gain a lot more over the next 10 to 15 years. That’s what matters more to you as an investor.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in MercadoLibre. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, MercadoLibre, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

1 Stock That Could Be Worth More Than Amazon by 2039 was originally published by The Motley Fool

Signup bonus from