A number of companies have moved on from the pandemic’s challenges to reach new heights. Rough times have a way of separating great companies from merely good ones, and although no one is asking for difficulties, these moments can often strengthen a business for the better.

But not every top company is out of the woods just yet. Walt Disney (NYSE: DIS) is still reeling from challenges of the past few years, with new ones taking the place of old ones and keeping Disney stuck in a rut. There have been pockets of good news throughout, and Disney recently made a sweet announcement to start the new year off right.

What is this exciting present?

Disney suspended its dividend in light of pandemic difficulties, and although it has been almost four years and the parks business has rebounded, it hasn’t reinstated it until now. Management said that it would issue a dividend of $0.30 on Jan. 10 to shareholders as of Dec. 11, 2023. That implies a yield of 0.66%, which isn’t great, but it’s a start.

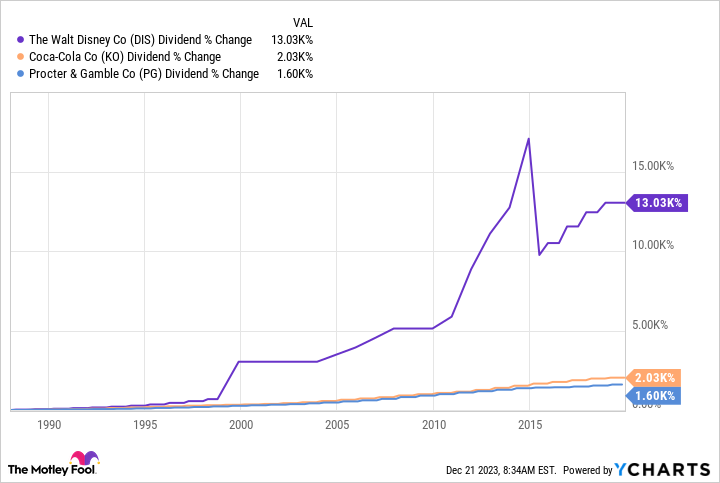

Prior to the suspension, Disney’s dividend yielded around 1.5%, or about the S&P 500 average. Disney is an old stock, having traded over the counter since 1940 before an initial public offering in 1957. It has paid a dividend from the beginning but only started raising it in 1989.

It has had a great run, growing much more than storied dividends from stocks like Coca-Cola and Proctor and Gamble, before being put on hold in 2020.

Is now the right time?

Disney’s been through a lot of ups and downs over the past four years, including a new CEO — and now its old CEO. Bob Iger is trying to set things straight by reverting to the company’s tried-and-true model of a powerful parks segment and blockbuster films, both fueled by an incredible content-creation machine. He’s aiming to get streaming spending under control, boost profits, and reward shareholders.

Shareholders have been disillusioned by Disney’s ongoing challenges, and Disney stock is up just 6% this year, sharply underperforming the market. It’s still 53% off its highs, and it’s going to take more work to drive the share price higher.

According to Board Chairman Mark Parker, “This has been a year of important progress for The Walt Disney Company … As Disney moves forward with its key strategic objectives, we are pleased to declare a dividend for our shareholders while we continue to invest in the company’s future and prioritize meaningful value creation.”

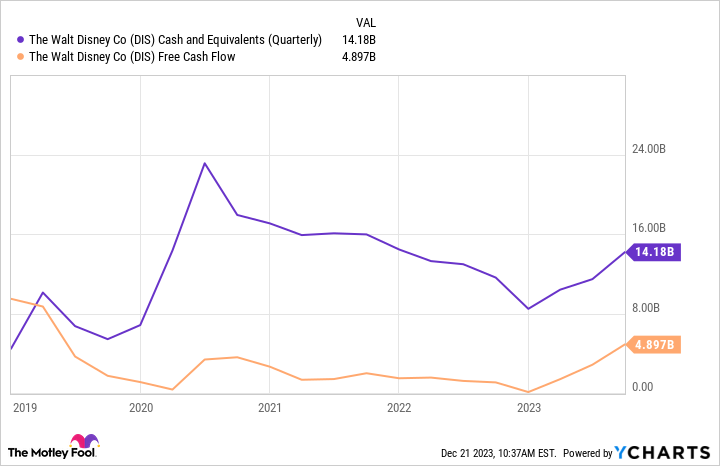

On the most recent earnings call, Iger mentioned a strong balance sheet and robust cash flow as an impetus to restart the dividend. These are both bouncing back nicely, and now that Disney has the money, it’s giving back to patient shareholders.

Disney has the money to pay the dividend, and it doesn’t look like investors need to worry about its ability to pay it and keep operations running.

Should you gift yourself some Disney stock?

Don’t buy Disney stock for the January dividend; you’ll get better yields elsewhere. This is mostly a gesture that says, “We’re back.” However, it does look like things are moving in the right direction for Disney, and this could be the start of a real rebound for the media giant.

Should you invest $1,000 in Walt Disney right now?

Before you buy stock in Walt Disney, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walt Disney wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Jennifer Saibil has positions in Walt Disney. The Motley Fool has positions in and recommends Walt Disney. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

The New Year Is Here and Disney Has an Exciting Present for Shareholders was originally published by The Motley Fool

Signup bonus from