On Dec. 20, Axios reported that Warner Bros. Discovery (NASDAQ: WBD) was in talks to potentially merge with Paramount Global (NASDAQ: PARA). The news wasn’t positively received by investors, with both stocks dipping between 5% and 8%, respectively, in the days following.

Paramount has been under intense pressure to find a partner or buyer as it faces significant debt. Meanwhile, since WarnerMedia and Discovery came together in 2022, its key objective has been to pay down the considerable debt it accrued from merging. Combining Warner Bros. Discovery and Paramount would therefore create a company that would start out substantially in the red.

However, a merger wouldn’t be all bad news over the long term. The last two years have seen Warner Bros. Discovery become an expert at paying down large sums of debt, suggesting it might be up to the task if it were to take on Paramount. Meanwhile, the addition of Paramount’s assets could make the company a formidable opponent in television, film, news, and sports against industry giants like Disney.

So, is Warner Bros. Discovery worth buying ahead of a potential merger in 2024? Let’s take a look.

The potential to create an entertainment behemoth

First off, it’s important to note that these companies would not start on equal footing, with Warner Bros. Discovery’s market cap at $28 billion and Paramount’s at just under $10 billion. The imbalance aligns with information from Axios that says discussions between Warner Bros. Discovery CEO David Zaslav and Paramount CEO Bob Bakish this week floated the idea of WBD either buying out Paramount or its parent company National Amusements.

The merger of these companies would create a titan of entertainment. For instance, combining Warner’s CNN with Paramount’s CBS News would result in one of the world’s biggest news organizations. A similar sentiment could be said about CBS and WBD’s sports networks, which currently share television rights for March Madness. Additionally, the merger of Max and Paramount+ could be highly competitive against streaming services from Disney and Netflix.

In fact, WBD and Paramount film releases have grossed a combined $2 billion domestically and nearly $5 billion globally at the box office this year, which would put them ahead of any other studio.

The merger of Warner Bros. Discovery and Paramount could be a huge win over the long term. However, with both staring down a mountain of debt, prospective investors would need to be in it for the long haul.

It’s probably best to wait on Warner Bros. Discovery stock for now

When WarnerMedia merged with Discovery in early 2020, the newly formed company was saddled with about $52 billion of debt. The entrainment firm has spent the last year aggressively paying that down with various cost-cutting measures, with that figure down to about $43 billion as of the third quarter of 2023.

However, absorbing Paramount would basically put WBD back to square one, taking on the company’s reportedly $16 billion in long-term debt.

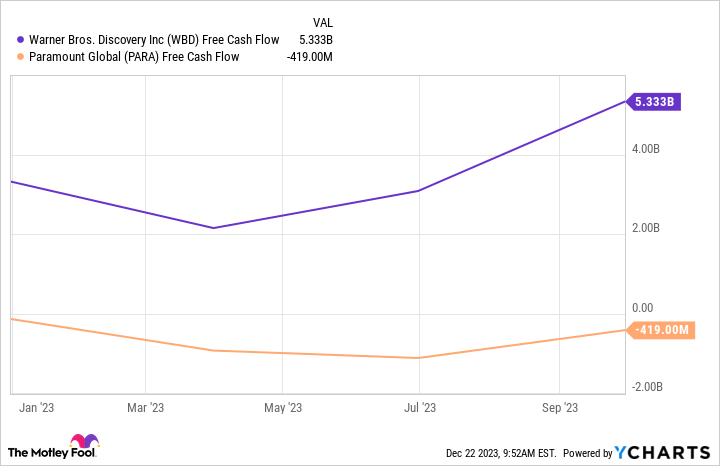

Warner Bros. Discovery is seemingly on a positive growth trajectory, with its debt trending down and its free cash flow hitting over $5 billion this year. However, this chart shows it’s a different story at Paramount, with its free cash flow deep in the red.

Regarding WBD buying Paramount, MoffettNathanson analyst Robert Fishman was quoted asking “Why would any company try to catch a falling knife?”Many investors clearly share a similar take on the situation, with Warner Bros. Discovery’s stock tumbling this week. It’s difficult to see how this merger would benefit shareholders when it could effectively wipe away the progress it’s made this year.

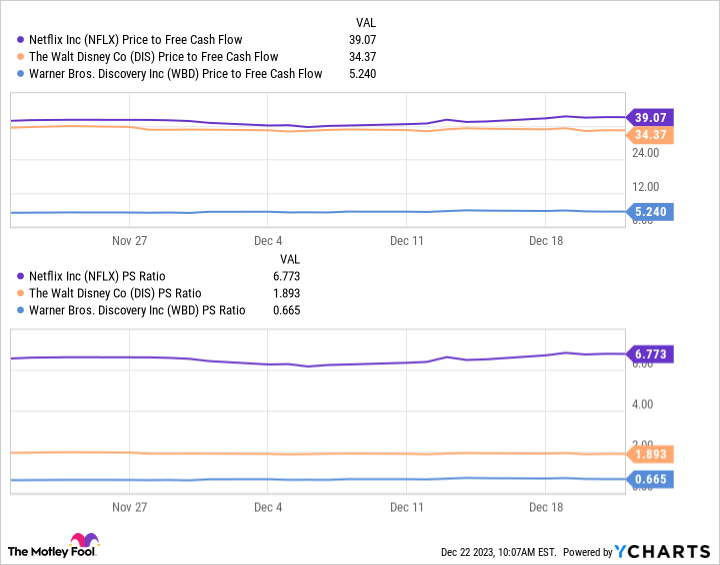

As a result, it’s best to hold off on buying stock in Warner Bros. Discovery for now. Compared to other entertainment giants, its stock is cheap, as seen by its lower price-to-free-cash-flow and price-to-sales ratios above.

However, announcing a merger with Paramount in 2024 would likely result in its stock price plunging further, presenting a better buying opportunity. If the company’s share price dips, you could make a long-term investment in what could eventually become an entertainment behemoth.

Should you invest $1,000 in Warner Bros. Discovery right now?

Before you buy stock in Warner Bros. Discovery, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Warner Bros. Discovery wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix, Walt Disney, and Warner Bros. Discovery. The Motley Fool has a disclosure policy.

Warner Bros. Discovery Is in Talks to Merge With Paramount: Is Its Stock a Buy for 2024? was originally published by The Motley Fool

Signup bonus from