The primary measure of inflation is the Consumer Price Index (CPI), which represents the change in price for a basket of goods and services. The U.S. Federal Reserve has a mandate to keep inflation under control, and it targets a CPI increase of 2% each year.

But significant changes in inflation above or below the Fed’s target can have a huge impact on asset prices, especially for stocks and housing. The CPI is on track for a steep deceleration in 2023 — of a magnitude similar to 2009 and the early 1980s. The S&P 500 (SNPINDEX: ^GSPC) stock market index staged a huge move on both of those occasions, so here’s what could happen in 2024.

Inflation reached a 40-year high in 2022

Too much inflation can place pressure on households and businesses because their money buys fewer goods and services, leading to a slowing economy. On the flip side, not enough inflation — or even falling prices (deflation) — can force businesses to pull back on production and lay off employees. That also hurts the economy.

A few things can move inflation: interest rates, government spending, money supply, and supply chain shocks. Throughout the worst of the pandemic in 2020 and 2021:

-

Interest rates were at historic lows.

-

The U.S. government flooded the economy with trillions of dollars in stimulus.

-

The Fed was using quantitative easing, which increases money supply to stimulate the economy.

-

COVID-19 outbreaks caused factory closures around the world, which disrupted supply chains.

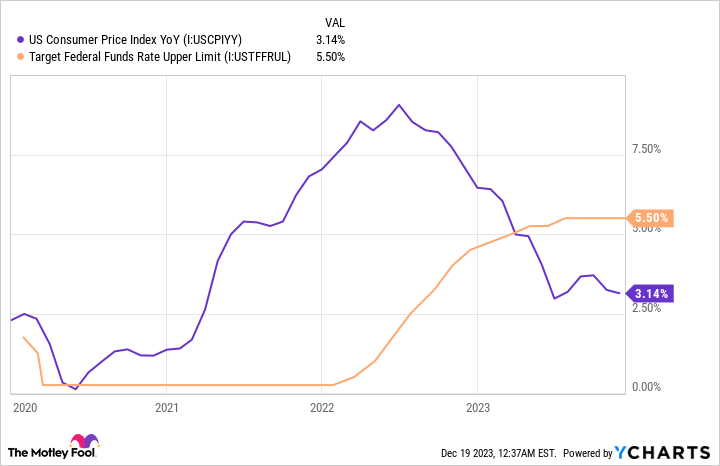

All of those things were inflationary, so it’s no surprise the CPI soared to reach a 40-year high of 8% in 2022, far beyond the Fed’s target. It sent the S&P 500 plunging 18% for the year.

In response, the Fed raised interest rates from 0.25% to 5.50% over the last 18 months to counteract that inflation. It’s working so far with the latest CPI reading for Nov. 2023 coming in at an annualized rate of just 3.1%.

With December almost in the books, the CPI is likely to end 2023 with an average annualized increase of 3.5%. That would mark a 4.5 percentage point decline from 2022, when the CPI came in at 8%.

The last time the CPI slowed by more than 4 percentage points in a single year was in 2009, and before that, 1982.

Falling inflation is great for the stock market

As I mentioned earlier, deflation tends to be bad for the economy and the stock market. But when the CPI is rising too quickly, a decline toward the Fed’s 2% target is exactly what consumers, businesses, and investors want to see.

It can boost corporate profit margins because businesses are paying less for their input costs, and it reduces prices for consumers leading to more economic growth. But most importantly, falling inflation prompts the Fed to reduce interest rates, which lowers the cost of capital. That means businesses can access funding more easily to grow and expand their operations.

CPI inflation averaged 3.8% during 2008, but it collapsed 4.2 percentage points to negative 0.4% in 2009. The banking crisis ground the economy to a halt, which is why the CPI fell into deflation territory. But the Fed responded by slashing interest rates and introducing quantitative easing for the first time. Plus, the U.S. government stepped in to bail out some of the major U.S. banks. Those moves gave investors confidence that deflationary pressures would be short-lived.

As a result, the S&P 500 ended 2009 with a gain of 26.4% (including dividends). But that’s not all; inflation remained within the Fed’s target for years even with interest rates near record lows, so 2009 sparked the beginning of a nine-year winning streak for the stock market.

There was a similar occurrence in the early 1980s. CPI inflation hit 10.3% in 1981 which sent the S&P 500 tumbling 4.9%. But it slowed more than 4 percentage points in 1982, driving a 21.5% return in the stock market. Inflation continued to fall, and 1982 marked the beginning of an eight-year bull run for the S&P 500.

History points to more upside in 2024

The Fed hasn’t started cutting interest rates yet, but the S&P 500 has jumped 24% in 2023 thanks in part to falling inflation. Plus, experts predict a shift in policy is right around the corner from the Fed. The CME Group‘s FedWatch tool points to a whopping six rate cuts next year!

As was the case in 1982 and 2009, it’s possible 2023 is the beginning of a multiyear bull market in the S&P 500. If history repeats itself, 2024 will likely bring more positive returns.

Investors should keep an eye on CPI inflation in the coming months. So long as it continues to steadily decline toward the Fed’s 2% target — and absent any unexpected economic shocks — the stock market will remain a great place for your money.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

Inflation Is Doing Something It Hasn’t Done Since 2009, and It Could Trigger a Big Move in the Stock Market in 2024 was originally published by The Motley Fool

Signup bonus from