Lumen (NYSE: LUMN) stock jumped in Thursday’s trading. The telecom company’s share price closed out the daily session up 4.8%, according to data from S&P Global Market Intelligence.

Bloomberg published a report yesterday stating that Lumen is looking to extend the deadline for its pending debt-restructuring deal. Per the report, Lumen’s creditors have accepted an extension.

Why is Lumen’s debt restructuring important?

Lumen carries roughly $19.7 billion in debt on its books. Meanwhile, the company closed out today’s trading with a market capitalization of $1.75 billion.

Interest rates remain high, and the company’s heavy debt load is creating substantial interest-related expenses. At the same time, Lumen is also aiming to invest in potential growth drivers including fiber communications, edge computing, and security services.

By pushing the due dates for its loan payments further out, the company can potentially put itself in a better position to meet debt obligations while still investing in opportunities that could help get the business back on track. News that key creditors are amenable to pushing the deadline for the company’s debt restructuring further out reduces the risk of an eventual default or bankruptcy.

Lumen stock is beaten down and still risky

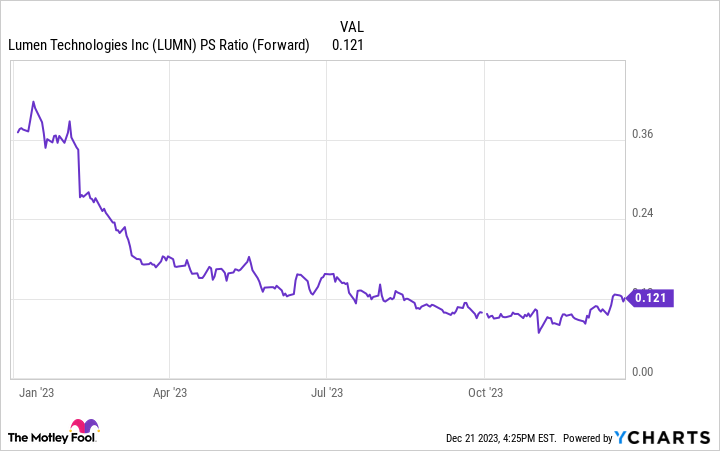

The company’s stock has lost roughly 67% of its value year to date. Lumen’s share price also trades down 96.5% from its lifetime high. Massive sell-offs have pushed the company’s valuation down to levels that look dirt cheap by some metrics, but the situation is complicated.

Trading at roughly 12% of this year’s expected sales, Lumen stock looks quite cheaply valued for a company that’s still posting meaningful profits on a non-GAAP (adjusted) basis. The company is currently valued at roughly 18x this year’s expected earnings.

On the other hand, earnings are broadly expected to slip next year. Lumen trades at approximately 38x the average analyst estimate for next year’s expected profits. If the business can stabilize and demonstrate that it can make progress on paying down its debt load, shares could skyrocket from current levels. But investors should approach the stock with the understanding that the bankruptcy risk for Lumen is still on the table.

Should you invest $1,000 in Lumen Technologies right now?

Before you buy stock in Lumen Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lumen Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Lumen Stock Surged Today was originally published by The Motley Fool

Signup bonus from