Intel‘s (NASDAQ: INTC) fortunes on the stock market have turned around tremendously in 2023 as shares of the chipmaker have gained 74% this year, and the good part is that Chipzilla is likely to sustain its impressive momentum in the new year as well thanks to new artificial intelligence (AI) chips that could help it capture lucrative opportunities in two fast-growing markets.

On Dec. 14, Intel unveiled new AI chips targeting the personal computer (PC) and data center markets. Investors liked what they saw as Intel stock jumped following the event. Let’s see why the market gave Intel’s AI chips the thumbs-up and check how they can help the stock sustain its rally in 2024 and beyond.

Intel sees a huge opportunity in AI-powered PCs

The personal computer (PC) market is expected to witness a big turnaround in 2024. Market research firm Canalys anticipates an 8% jump in PC sales next year, followed by double-digit growth in 2025, 2026, and 2027. For comparison, PC shipments are expected to drop 12.4% in 2023.

Canalys points out that the adoption of PCs capable of running AI applications will be a driving force behind the market’s growth. The firm estimates that 19% of PCs shipped in 2024 will be AI-capable, which explains why Intel is going aggressively after this market.

Intel unveiled Core Ultra central processing units (CPUs) at its “AI Everywhere” event, stating that they will “power more than 230 of the world’s first AI PCs from partners including Acer, ASUS, Dell, Dynabook, Gigabyte, [Alphabet‘s) Google Chromebook, HP, Lenovo, LG, Microsoft Surface, MSI, and Samsung.”

Intel also adds that it is partnering with over a hundred independent software vendors to optimize more than 300 AI-accelerated features for its Core Ultra processors. More importantly, the company points out that consumer PCs powered by its AI-capable CPUs are already on sale, and it will soon launch commercial devices as well.

Intel believes that 80% of PCs sold in 2028 will be AI-capable. So, Intel is doing the right thing by moving into this market right now as sales of AI PCs are expected to gain momentum starting next year. It is worth noting that Intel’s revenue from the client computing group was down 3% year over year in the third quarter of 2023 to $7.9 billion. That was a nice improvement over the 12% year-over-year decline in the segment’s revenue in the second quarter, indicating that its largest business is now stabilizing.

The advent of AI PCs should fuel the performance of this business and drive Intel toward growth from next year as the client computing group accounts for 56% of its top line. At the same time, investors should note that Intel has set its sights on another massive opportunity within the AI niche, which could supercharge the growth of its second-largest business.

New server processors could unlock a new growth opportunity

Along with AI-powered PC processors, Intel also launched its fifth-generation Xeon server processors, codenamed Emerald Rapids. The company points out that these processors have been designed for AI and can “address demanding end-to-end AI workloads before customers need to add discrete accelerators.” As a result, Intel points out that its latest server processors can help reduce the operating costs of data centers significantly, as discrete graphics cards that are used for accelerating AI workloads are quite expensive.

Intel claims that its latest-generation processors deliver an average performance gain of 21% and have a 36% higher average performance per watt over the previous-generation offerings, making them more powerful and power efficient at the same time. What’s more, Intel says that the fifth-gen Xeon processors can deliver “up to 42% higher inference performance and less than 100-millisecond latency on large language models (LLMs) under 20 billion parameters.”

It won’t be surprising to see Intel’s new server chips gaining traction, as the company sees strong demand for small to medium-sized LLMs. OpenAI’s ChatGPT, for instance, has 20 billion parameters and falls within the category of small to medium LLMs, while large models typically have more than 100 billion parameters.

More specifically, Intel estimates that 60% of the opportunity within AI accelerator chips lies in the general computer space where CPUs will be deployed for training small to medium models. As such, Intel’s new server processors can boost the revenue of its data center and AI business segment. This business generated $3.8 billion in revenue last quarter and was its second-largest segment with 27% of the top line.

Investors can expect the stock to deliver healthy gains

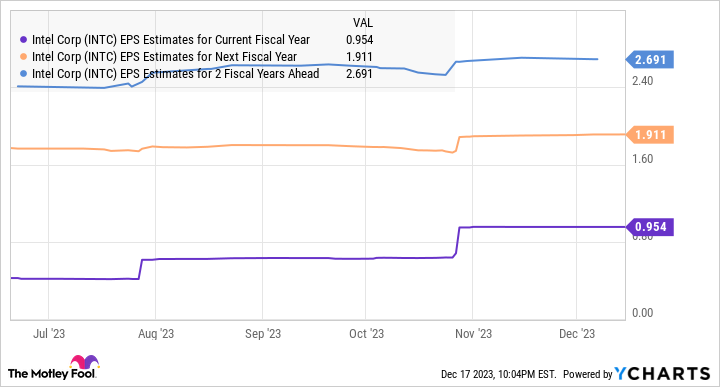

The above discussion suggests that Intel’s two biggest businesses could regain their mojo in 2024. This explains why analysts are anticipating a nice acceleration in the company’s growth from next year.

As the table above tells us, Intel’s earnings are expected to increase to $2.70 per share in 2025. Multiplying that with the Nasdaq-100 index’s average forward earnings multiple of 27 points toward a stock price of $73, which would be a 59% jump from current levels. However, Intel could deliver even better gains if the market rewards it with a higher earnings multiple thanks to its AI-powered growth, which is expected to significantly accelerate the company’s bottom line over the next three years.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, HP, and Microsoft. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

This Hot Chip Stock Could Be a Top Artificial Intelligence (AI) Pick for 2024 and Beyond was originally published by The Motley Fool

Signup bonus from