If it feels like only large technology stocks went up in 2023, your feelings are correct. The market has been led by the explosive returns from the “Magnificent Seven” technology stocks, leaving virtually every other company in the dust.

One lagging stock this year was Lockheed Martin (NYSE: LMT). The large defense contractor posted a total return of -6% in 2023 versus a 24.8% boost for the broad S&P 500 index.

Even though the threat of war continues in multiple regions around the globe, investors have soured on defense contractors such as Lockheed Martin. Its earnings multiple has collapsed, presenting investors with a chance to buy shares at a discount. So is it time to bet on a turnaround for Lockheed Martin in 2024 and buy the dip?

Slow but steady growth; strong moat

You’re not going to get explosive revenue growth from Lockheed Martin. The maker of fighter jets, space equipment, and other tools for the United States government and its allies moves methodically but has a highly reliable business. With contracts that can extend for decades, Lockheed Martin’s business is extremely predictable, making it a great choice for investors looking for low-risk investments. The company is ingrained within the United States military, giving it a wide moat — or competitive advantage — versus other companies trying to win government contracts.

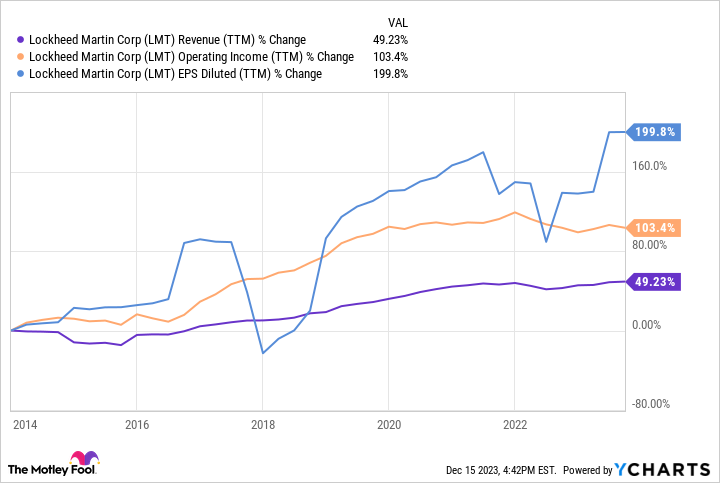

Throughout the years, as military budgets have grown, Lockheed Martin’s revenue has grown along with it. Over the past 10 years, revenue is up 49%. Only a few periods have seen revenue declines.

With economies of scale, Lockheed’s profit margins have expanded, leading to earnings growing faster than revenue. In the last 10 years, Lockheed’s operating income has grown by over 100%. Not bad for a “stodgy” defense contractor that’s ignored by growth investors.

Consistently returning capital to shareholders

On top of consistent growth, Lockheed Martin has been top-notch at returning capital to shareholders. In practice, this means consistent repurchases of its stock and increasing dividend payouts. Intelligently returning capital is underrated by many growth investors, even though it can be quite meaningful to stock returns.

Using the same 10-year timeframe as the above section, Lockheed’s dividend payout has grown by 151%. After buying back a lot of its stock from existing shareholders, its shares outstanding have declined by 23%. Add all this together, and the company’s earnings per share (EPS) are up 200% in the last 10 years.

Over the long term, stock prices follow EPS growth, so it is no surprise to see Lockheed’s total shareholder return of 321% in the last 10 years. But you may be surprised to see this return level is above the S&P 500 over the same time, which returned 218% for shareholders. Again, not bad for a stock many people seem to forget about.

You can buy the stock today on the cheap

The good news for investors is you can buy shares of Lockheed Martin today at a discount to the market average. Today, the S&P 500 has an average price-to-earnings ratio (P/E) of 26. Lockheed’s trailing P/E is 16.5.

If we look at free cash flow, the numbers look similar. Free cash flow is an important metric to look at along with earnings, as it is the true cash a company is generating from its product and services. Lockheed Martin is guiding for $6.2 billion in free cash flow this year, which would give it a price-to-free cash flow (P/FCF) of 17.5. Again, this is well below the market average.

Add it all together — strong competitive advantages, consistent growth, and a discounted P/E — and Lockheed Martin looks like a slam dunk buy for investors in 2024. Buy this durable grower, and never sell your shares.

Should you invest $1,000 in Lockheed Martin right now?

Before you buy stock in Lockheed Martin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lockheed Martin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

This Defense Giant Trailed the Market in 2023: Time to Bet on the Stock’s Turnaround in 2024? was originally published by The Motley Fool

Signup bonus from