When it comes to the pharmaceutical industry, weight-loss medications are all the rage right now. While Ozempic maker Novo Nordisk dominates medications designed to treat obesity and diabetes, two other companies are looking to get their slice of the pie — but only one is succeeding.

Let’s break down some alternatives to Novo Nordisk, and assess why one competitor looks like a great buy in 2024 while the other appears too risky.

The stock to buy hand over fist: Eli Lilly

Eli Lilly (NYSE: LLY) manufactures a diabetes treatment called Mounjaro. Chances are you’ve seen the commercials for the drug or may even know people who are prescribed it. Although Mounjaro has only been commercially available since mid-2022, demand for this medication is off the charts. Mounjaro generated $3 billion in revenue through the first nine months of 2023, making it Eli Lilly’s second-largest top-line contributor.

And just last month, the Food and Drug Administration (FDA) approved Mounjaro’s sister product, Zepbound. While Mounjaro is used to treat diabetes, Zepbound’s focal area is obesity. This is a major development for Eli Lilly as the company faces a fierce contest with Novo Nordisk.

By some estimates, the market for weight-loss medications could reach $200 billion by 2030. Although it’s probably too early to know whether these forecasts are accurate, the main takeaway is that the demand for products like Ozempic, Wegovy, Rybelsus, or Mounjaro don’t seem to be going away. Now, with the approval of Zepbound, Eli Lilly is well-positioned to acquire additional market share in the growing diabetes and obesity markets.

The thing investors should keep in mind is that Eli Lilly’s stock has rocketed 56% in 2023 thanks to its all-around successful portfolio. As of now, Eli Lilly stock trades at a forward price-to-earnings (P/E) multiple of 87 — roughly quadruple that of the S&P 500. It’s clear that the capital markets are placing a premium on Eli Lilly and are bullish on the company’s growth prospects.

But when thinking about the long term, investors should consider that Eli Lilly has yet to really benefit from Zepbound. Right now, the company’s sales related to weight-loss medications stem from Mounjaro and Jardiance. The approval of Zepbound for obesity adds an entirely new layer of opportunity for Eli Lilly and should not go overlooked. Although the stock isn’t exactly cheap, I would caution investors about trying to time the perfect opportunity to open a position.

I see Eli Lilly as much more than a developer of weight-loss medications given the depth of the company’s portfolio in addition to weight-loss products. The drugmaker also has treatments for cancer and autoimmune diseases, with both of these areas contributing billions in revenue. The company’s cancer drug Verzenio grew 62% through the first nine months of 2023, but an expanded indication approval from the FDA could imply that its long-term prospects could be far more robust.

To me, Eli Lilly represents a compelling opportunity in the pharmaceutical industry in general. With its long-term returns in excess of 1,000%, patient investors have been handsomely rewarded by owning this stock, and I don’t see that changing.

The stock to avoid like the plague: Pfizer

Another pharmaceutical company that’s looking to participate in the race among weight-loss treatments is Pfizer (NYSE: PFE).

While the company’s vaccine played a monumental role combating COVID-19, its pursuit of the diabetes and obesity markets isn’t looking too good. Although Pfizer still has some opportunities in its weight-loss pipeline, I wouldn’t hold my breath. The company is far behind Novo Nordisk and Eli Lilly, and even if it makes some inroads eventually, I think it’ll be too little, too late.

Don’t get me wrong. Pfizer has a large portfolio of medications, and its waning aspirations toward the weight-loss market isn’t catastrophic. However, investors should keep in mind that its treatments for COVID-19 are not necessarily a catalyst anymore.

And as Pfizer enters the closing stages of its Seagen acquisition, I surmise that a significant amount of transaction costs will take a toll on the company’s earnings growth. The markets are clearly accounting for the company’s dwindling prospects given that shares of Pfizer stock are trading near their lowest point in a decade.

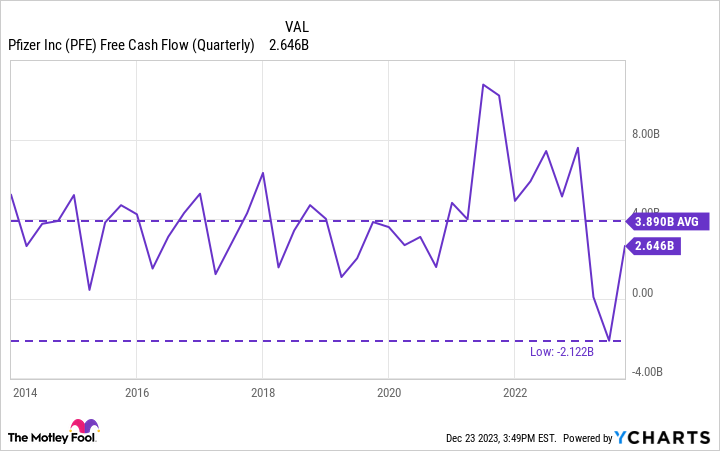

Moreover, with free cash flow generation both unpredictable and much lower than historical levels, Pfizer may face liquidity constraints as it integrates Seagen next year. While this is purely speculation, the company may be forced to seek further cost-saving efforts, which could come in the form of slashing its dividend.

I think there are simply too many risks associated with an investment in Pfizer right now, and I don’t view its current price action as an opportunity to buy the dip. Unless Pfizer can prove that it’s on a more respectable path for revenue and profit growth, I’d leave the stock alone and seek better opportunities.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Adam Spatacco has positions in Eli Lilly and Novo Nordisk. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Interested in the Weight-Loss Market? Here’s 1 Stock to Buy Hand Over Fist in 2024, and 1 to Avoid Like the Plague. was originally published by The Motley Fool

Signup bonus from